Investors have and continue to spend countless efforts to “time” the market – e.g. buy or sell a stock at an advantageous point and make a profit. The prediction criteria used for these types of strategies can include economic or financial data, market conditions, technical signals (think of these like patterns of varying complexity), and even astrology (not advisable). Since investors are humans (as opposed to algorithms), the underlying catalyst for trying to time the market most likely comes from heuristics, or behavioral shortcuts that we have been using as a species since our origin. Trust your gut. It just feels right. It has to work out. Someone I respect agreed with me.

Full disclosure, I don’t believe that market timing can be a sustainable, winning strategy. I do believe people have done it, but attributing it to skill vs. luck tends to be based on who tells the story.

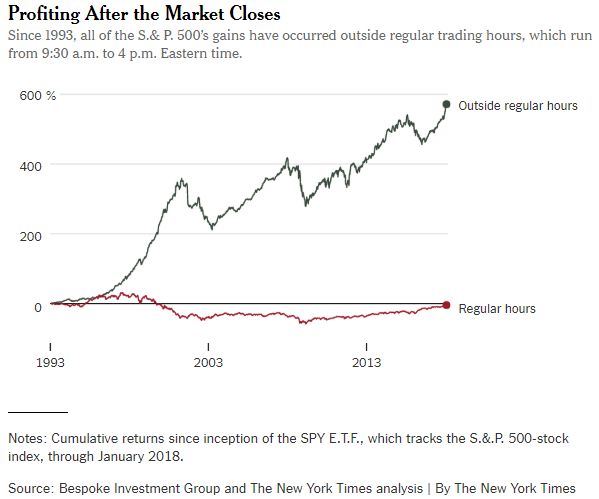

That being said, I think I found THE winning market timing strategy!* Stay out of the stock market when its open and only invest when it’s closed. The NYTimes had a very interesting article back in February 2018 that took some great analysis by Bespoke Investment Group. I find it fascinating and amusing at the same time. Bespoke’s analysis showed that the returns on the market during trading hours (9:30am-4pm EST) were essentially flat while the returns outside of trading hours (4:00pm to next day at 9:30am EST) accounted for nearly all the gains over the past 25 years. Name another business that generates all its profits when closed!

There are definitely unanswered questions as to why this ‘strategy’ works or if it sustainable, but the takeaway for me is that an investor can really benefit if they take themselves out of the equation. Don’t be tempted to trade or time the market. Investor inertia is hard and often unfulfilling to our human instincts, but it sure can pay off.

Next time you feel the urge to place a trade, take a day and sleep on it. Based on this analysis, you may just come out ahead.

*Probably not

Source material:

https://www.nytimes.com/2018/02/02/your-money/stock-market-after-hours-trading.html