There is an “urban legend” in the investment advisory ethos that seems to manifest itself in a story that goes something like this: “A Fidelity employee said that they did a study to find out which of the customer accounts held at Fidelity did the best. They found that the best performing accounts were ones where the investor either never logged in or forgot they had the account!”

I’ve heard a handful of versions of this story throughout my career, and it’s always amusing to hear. Whether the story is true or not actually doesn’t matter to the message it implies; that is, ignoring or resisting the urge to do something in investing can be beneficial for you. The difficulty with adhering to that advice is that as human beings, we tend to crave feedback, whether it be verbal (“good job!”), quantitative (43 likes!) or observed (my 4-year old actually listened and got dressed himself!). Having a portfolio of stocks and/or bonds can produce one of the shortest feedback loops, simply by giving you a real-time scorecard of pluses and minuses. At any point during the day, you can log into your brokerage account and see real time stats. Instant feedback!

A problem that can arise with instant feedback in a portfolio is that it can solicit unnecessary reaction. Seeing those values or price changes in the dreaded red font (indicating a decline or loss) has never been enjoyable. But it doesn’t necessarily mean you did something wrong.

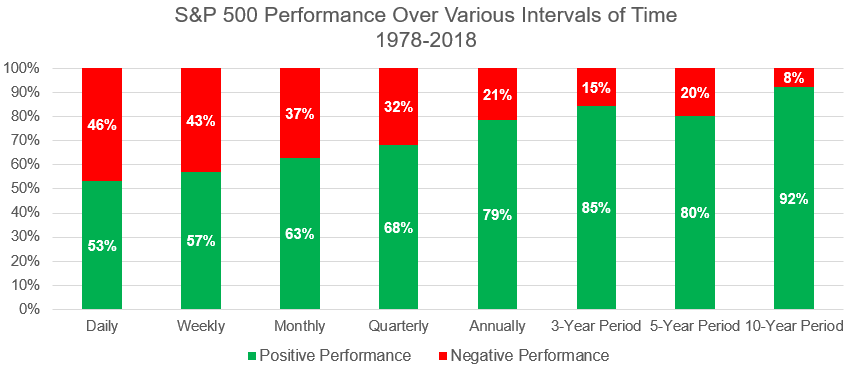

Data: Uses daily price returns of the S&P 500 Index. Rolling periods.

On any given day, the market’s probability of being up or down has been similar to a coin flip (50/50). If you extend the time of measurement to a month, a year, or even a 10-year period, the percentage of time that the stock market was up dramatically rises. Unfortunately, you can’t control the market outcome just by avoiding the urge to log into your account. But you can reduce the urge to have instant feedback become a trigger for sub-optimal decision making.

No part of a long-term financial plan spells out the requirement that you look at your brokerage accounts every day or week to see how you are measuring up. While that instant feedback is enticing, it’s not an appropriate measure of success. Take the lesson from the Fidelity story – ignorance can be bliss.