On May 2, St. Louis Trust & Family Office hosted a Symposium titled The Allure of the Endowment Model – What Individual Investors Can Learn. We chose this topic because we thought that examining the investment success of certain prestigious university endowments and the potential take-aways for individual investors would be of interest to our clients.

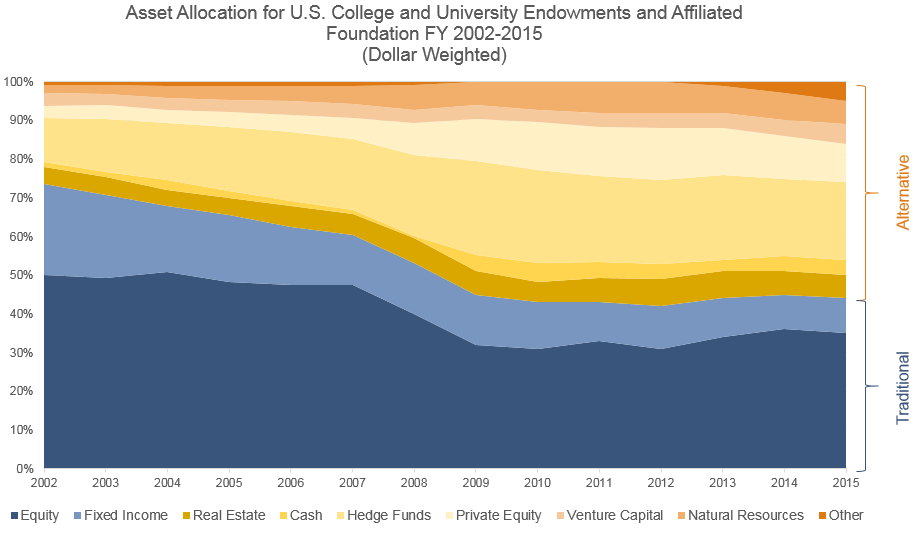

The investment success achieved by many of the large, prestigious university endowments is lusted after by other institutional and individual investors alike. It is no surprise that the investment strategies employed by those endowments are regarded as the gold standard, and attempts to emulate them is prevalent in the investment and consulting community with varying success rates. David Swensen, Chief Investment Officer of the Yale University endowment, pioneered the endowment model in the mid-1980s – drastically shifting the asset allocation from traditional public equity and bond investments to various illiquid, alternative investment strategies that provided higher return profiles and enough diversifying exposure to maintain attractive risk levels. As Yale’s performance success enters its fourth decade, endowments, foundations, and ultra-high net worth investors continue to aspire towards it with the added pressure of delivering a suitable return in a challenging investing environment.

The three panelists, including myself, discussed (1) the validity of the endowment model, (2) what small endowments/foundations and individual investors can apply, and (3) what frictions exist that prevent this model from being fully exploited.

We believe there are four key take-aways for ultra-high net worth investors:

- It’s more than just making an allocation to alternatives, it’s about the process and access.

- The playing field is not level – you are taxed, endowments are not.

- Illiquid strategies require structure and a long-term commitment.

- There’s no disadvantage (or shame) to investing traditionally.

1 – It’s More Than Just Making an Allocation to Alternatives, It’s About the Process and Access

Shifting your investment portfolio to alternative asset classes in an effort to mirror a large endowment does not automatically raise your return profile while holding risks constant. The performance success of Yale and other endowment model pioneers are attributable to having a rigorous investment process with highly skilled and tenured staff, a first-mover advantage, accessibility to an extensive network of elite investment talent (often alumni), and sizable pools of money.

2 – The Playing Field Is Not Level – You Are Taxed, Endowments Are Not

When Benjamin Franklin famously said, “In this world nothing can be said to be certain, except death and taxes,” he wasn’t talking about endowments, which are structured as tax-exempt entities and can live forever. Taxes should be an input to the asset allocation decision, not an afterthought. Successful endowments are able to allocate capital to all areas of the investment universe without any consideration of the tax impact. This gives them a significant after-tax return advantage relative to individual investors. Fortunately, individual investors can exhibit some control over their potential tax footprint and invest in more tax-efficient strategies for their traditional investments. One example would be to use passive ETF strategies that tend to exhibit less turnover (and thus less capital gains) and aren’t subject to mutual fund distributions that are triggered from other investors’ redemptions. While taxes may be unavoidable in alternative investment strategies, individual investors can increase their capacity for these tax-inefficient strategies by more tax-effectively managing their stock and bond allocations.

3 – Illiquid Strategies Require Structure and a Long-Term Commitment

Most alternative asset investment strategies require your money to be committed and/or tied up for months or years. Investors who decide to embrace and allocate to these illiquid strategies should maintain that long-term commitment even when it is painful to do. Market timing is a hard game to consistently win, and it is particularly difficult in the alternatives space. Individuals must accept a potential scenario where these investments are tied up at inopportune times. For example, during the financial crisis many endowments had funding commitments to illiquid investments just at the time their liquid investments were free-falling. In order to raise liquidity to cover annual obligations to their universities, the endowments looked to sell their alternative investments and faced sizable price concessions. Investors shouldn’t embrace illiquidity at one point of time and abandon it soon after.

4 – There’s No Disadvantage (Or Shame) To Investing Traditionally

The endowment model isn’t an infallible approach to investing – many who have tried to implement it have subjected themselves to mediocre returns and even underperformed a simple allocation of stocks and bonds. Ultra-high net worth investors who value liquidity, simplicity, and tax-efficiency can structure investment portfolios with traditional assets like stocks and bonds and still generate an attractive return profile over the long term. Alternative asset classes can provide diversification and return-enhancing benefits, but the illiquidity and tax ramifications are critical components to consider.

An investor’s investment allocation should ultimately reflect their financial goals, risk appetite, spending/liquidity needs and their willingness to embrace additional complexity. We recommend investors focus on what they can control and understand, which includes investment fees, taxes and behavior. By controlling these elements of an investment program, individuals can more effectively navigate the challenges and opportunities of an alternative allocation.

Related Books of Interest:

Swensen, David. Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment. Free Press. 2009 (Revised)

Swensen, David. Unconventional Success: A Fundamental Approach to Personal Investment. Free Press. 2005