In 2016, I had dinner with two men: the Chief Investment Officer of a firm that provides both cap-weighted and factor-weighted indexes and the top investment strategist of one of the largest investment consulting firms in the world. After a few glasses of wine, our discussion turned to how we would invest $100 million if we won Powerball. Both gentlemen said that the vast majority of their investments would be in the cap-weighted index.

“Why wouldn’t you use an index weighted to a factor like quality, dividends paid, or low volatility since those strategies should deliver higher performance over the long term? Or invest with high-conviction active managers who might beat the market?” I asked.

Both gave me the same response: it’s too hard behaviorally, and they weren’t sure they could stick with a strategy that delivered years of underperformance.

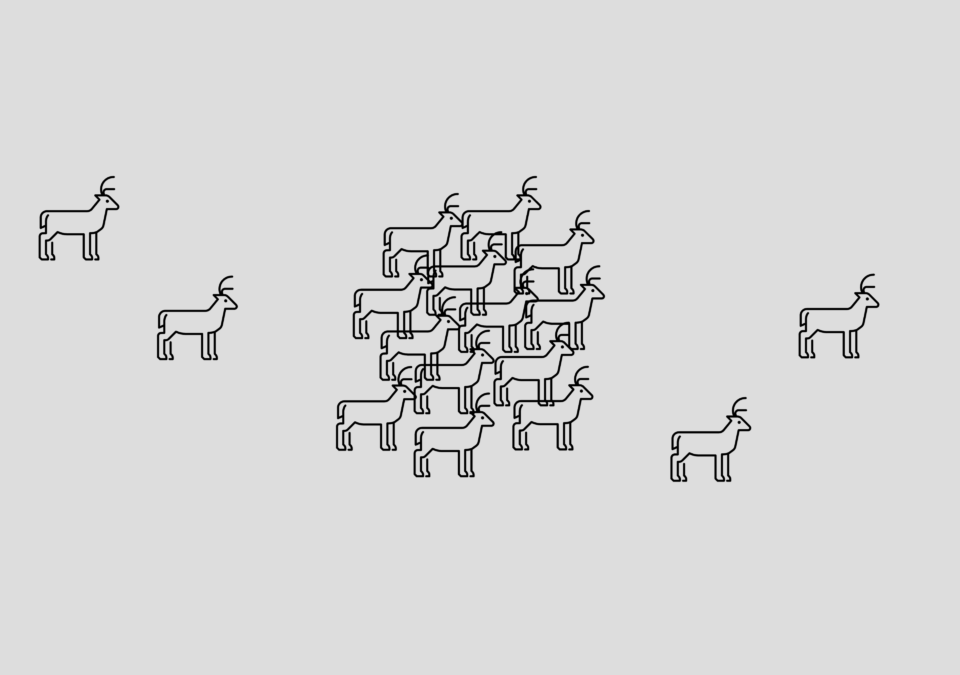

This conversation has stuck with me over the years. If two seasoned and erudite investment experts don’t think they can emotionally handle being different from the market, what does that say for the rest of us? It reflects something I think of as the paradox of the herd: to get different returns than the market, you must invest differently, but that means leaving the herd. That’s not easy because the herd provides safety—perhaps not in reality, but emotionally and behaviorally.

A study by Vanguard supports the notion that it’s hard to be away from the herd. The study examined the performance of 1,540 active managers and found that only 18 percent of them beat their benchmarks. And if you were lucky enough to have invested with an outperforming manager, they’d be hard to stick with as 97 percent of them experienced at least five years of underperformance, and more than 60 percent experienced seven or more years of underperformance. Furthermore, two-thirds of these star managers underperformed for three or more consecutive years on their bumpy road to outperformance. Imagine how hard it would be to stick with (or add money to) an investment manager who’d underperformed for three or more years back-to-back-to-back. From my experience working with clients, I can tell you that it’s very hard indeed.

It’s hard for me too. An example is my own investments in low-volatility-weighted index funds. A well-known rule of investing is that if you seek higher returns, you need to assume more risk. But there’s an important anomaly secreted in this accepted wisdom: over time, stocks with low volatility tend to outperform ones with higher volatility, i.e., riskier stocks. Thus, an index that weights stocks according to volatility (with the lower-volatility stocks weighted more heavily than higher volatility ones) should outperform the riskier portfolio over time.

Based on this research, along with other studies that indicated that investing in non-capitalization weighted indexes provides better returns, years ago I began investing my own money in low-volatility index funds. These funds acted differently than the market. They outperformed some years and underperformed others. But over the ten years prior to 2020, they outpaced the herd. Then in 2020, the low-volatility funds massively underperformed. By massive, I mean it was really bad. How bad? My small-cap low-volatility ETF investment returned a negative 17 percent for the year versus its benchmark’s return of a positive 17 percent delivering underperformance of 34 percent.

This massive underperformance tested me. I’ve struggled with not selling my low-volatility ETFs in 2020 (but I resisted selling, and the fund had a great 2021). The point is that swimming against the market tide is not easy; investing differently than the rest of the market is a wild ride. Emotionally, it can be tough to stick to the strategy over the short term, even if you’re confident that it will outperform over the long.

As an investor, you should ask yourself if you can bear experiencing lower returns than the market for long periods. Most people can’t, and they should buy index funds that track the market so that the pain of underperforming the market is alleviated by the knowledge that the herd shares their pain. Additionally, index funds are low-cost and tax efficient, which is another reason they may be appropriate for investors.

But if you choose to invest differently than the herd, whether in a factor-weighted index fund, active manager, or a private investment, steel your emotions for the relatively wild ride that will inevitably result. Realize that your non-herd-like investments are bound to underperform the market – sometimes massively – for years because no investment strategy stays in favor permanently.