We get asked about stocks all the time. “A venture capital fund distributed me a stock. What should I do?” or “Should I buy Amazon?” or “Should I buy Nvidia here? It’s up 200% this year, and I believe it will continue that pace forever.” (Maybe they don’t say that last part out loud, but that’s what I hear in my head.)

If we need to learn more about a stock, Wall Street analyst research reports are one of the first places we go. A Wall Street analyst tends to cover a specific sector (e.g., software or biotech) that encompasses 10-15 stocks in that universe. They perform incredibly in-depth research on each of those companies, build relationships with the management and investor relations teams, and ultimately become a knowledge center on the companies and related industries. They (the sellers of research, or “sell-side”) provide their analysis to institutional investors (often referred to as the “buy side”). In addition to published research, analysts host management teams for investor meetings and conferences, providing investors with direct access they might not receive on their own.

So, analysts are valuable in the investment advice ecosystem. But should we put “stock” in their price targets and ratings (e.g., Buy, Hold, Sell)?

Price targets are what the analyst thinks the stock will trade at in the future. The ratings (e.g., Buy, Hold, Sell) correspond to how the current price relates to their price target. You see “Buy” ratings on stocks where the analyst forecasts a higher price and vice versa. “Hold” ratings typically imply “I am mailing it in and have no conviction” (sorry, my interpretation. Likely means “stock will perform in line with the relevant market”)

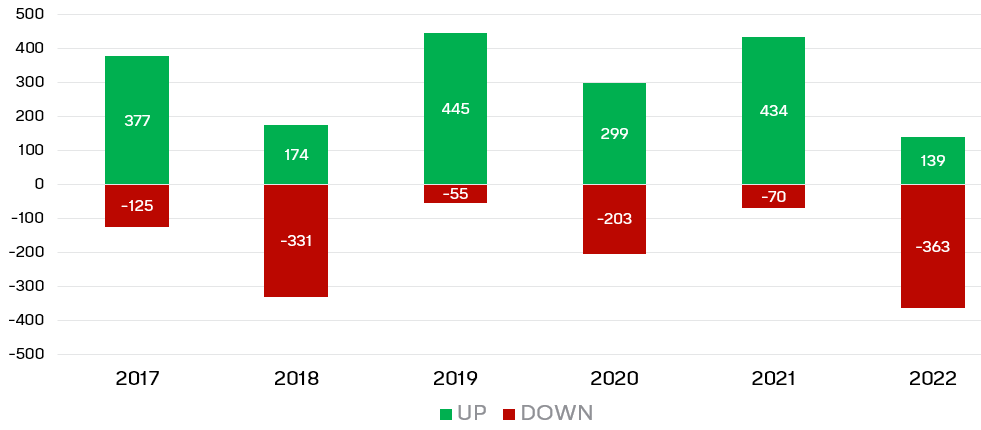

If we play the tape back, how many stocks are up and down each year? I only have data from the last several years, but the historical trend is a good representation. Below are the number of S&P 500 stocks that were up and down in the previous six calendar years. 2022 was tough – the S&P 500 had 363 stocks with negative returns!

Number of S&P 500 stocks that are up or down in a given calendar year (2017—2022)

The above chart shows a wide dispersion of the proportion of stocks up and down, ranging from a mere 11% of stocks being down in 2019 to 72% of stocks being in the red in 2022 (ugly!). Over the six-year period, on average, about 40% of S&P 500 stocks were down.

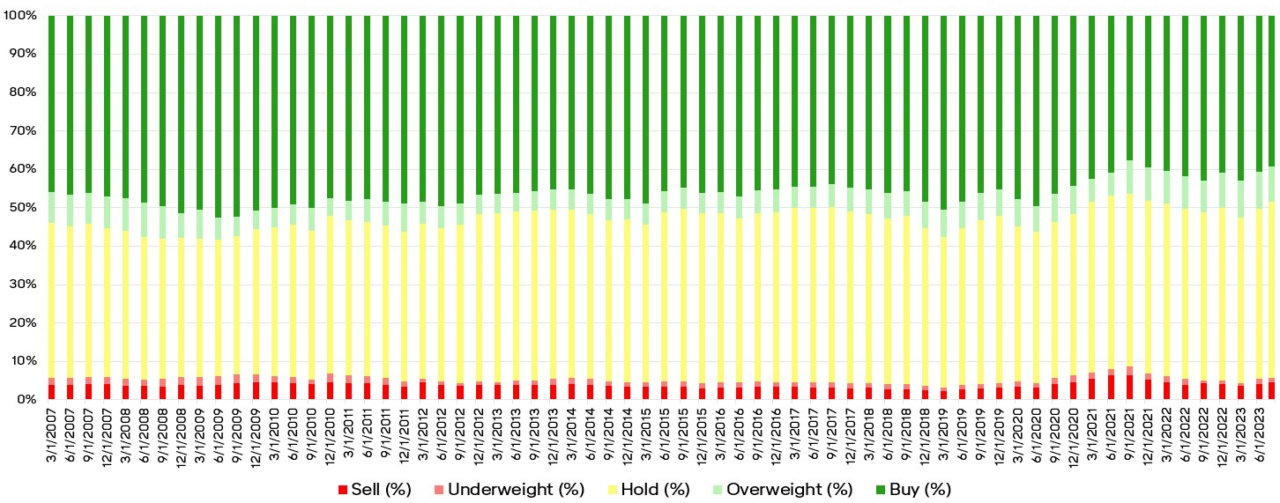

Let’s compare the above to the distribution of ratings provided by analysts. Analysts’ price targets are for 12-18 months in the future. If analysts were awesome at their job, you would surely see a healthy balance in buy and sell ratings, given that any 12-month period should see a wide dispersion of outcomes. Right?

Overall, there are currently 11,047 ratings on stocks in the S&P 500. Of these 11,047 ratings, 53.9% are Buy ratings, 40.5% are Hold ratings and 5.6% are Sell ratings. If you look at the breakout of those ratings going back to 2007, the distribution is consistent: there are very few Sell ratings.

Historical Breakout of Analyst Ratings for the S&P 500 Index Constituents (2007—2023)

Analysts are a ‘glass half full’ bunch! Listen to or read the transcript of a company’s quarterly conference call. You will undoubtedly hear analysts begin their question-and-answer opportunity with sentiments like “Congrats on the great quarter” (so supportive!).

A fun thing to think about:

As far as I know, any investor can participate in a company’s quarterly conference call. It isn’t exclusively for analysts. That said, the company likely has influence and probably doesn’t want to let anyone call in. But it would be fun to call in and tell Apple that “your cash balance is $166B; what say you guys invent a battery charger that doesn’t take hours to charge fully? Thanks, I’ll take my answer offline.”

Why are analysts so supportive of companies? There are several reasons, the not talked about one being that it’s good business to issue positive ratings because the banks providing the ratings would like the covered companies as customers. They want to sell them services like cash management and investment banking. Yep, analysts tied to the major banks don’t want to piss off management teams and threaten any future fee-bearing relationship they could extract from them. What should we take away here? Analyst research is helpful in learning more about a given company or an industry; the research contains a lot of great information. But sell-side price targets and ratings should be taken with a grain of salt.