A year ago, a Bloomberg survey of economists predicted that stubbornly high inflation and tightening financial conditions would cause a recession in 2023. Some even placed the probability of a 2023 recession at 100%. Wall Street was similarly dour, with the average strategist’s forecast for the S&P 500 negative for 2023. It marked the first time Wall Street had predicted a year in the red for stocks since 1999, Investing.com reported.

Of course, the consensus views from a year ago were utterly wrong, as the U.S. economy enjoyed strong growth in 2023, and the S&P 500 ended the year up 26.3%. The economy and stock market’s thwarting of the consensus predictions reminds me of rule nine of Bob Farrell’s 10 market rules to remember: “When all the experts and forecasts agree, something else is going to happen.” True.

My Stock Market Forecast

But not all predictions of 2023 stock market returns were wrong – mine was spot on. Last year, I predicted that “the market will probably be up, but there’s a decent chance it will be down,” and the market was indeed up. I also was correct in 2022 as I predicted that “the market will probably be up but might be down,” and the S&P 500, like I said it might be, was down 18.1%. My 2020 and 2021 predictions were similarly prescient: for those years, I said the market would probably be up but might be down, and the market was up 18% and 28.5%, respectively, as I said it probably would be.

My prediction for 2024 is the same: The market will probably be up, but it might be down.

Why do I make the exact same prediction every year? Because it reflects what has happened historically: the stock market has gone up about two in every three years. And that is about as specific as we can be about predicting market returns with any accuracy.

What About After Strong Returning Years Like 2023?

Investing in the stock market is like flipping a weighted coin that comes up heads most of the time. And that probability is about the same regardless of past returns – even after strong years like 2023.

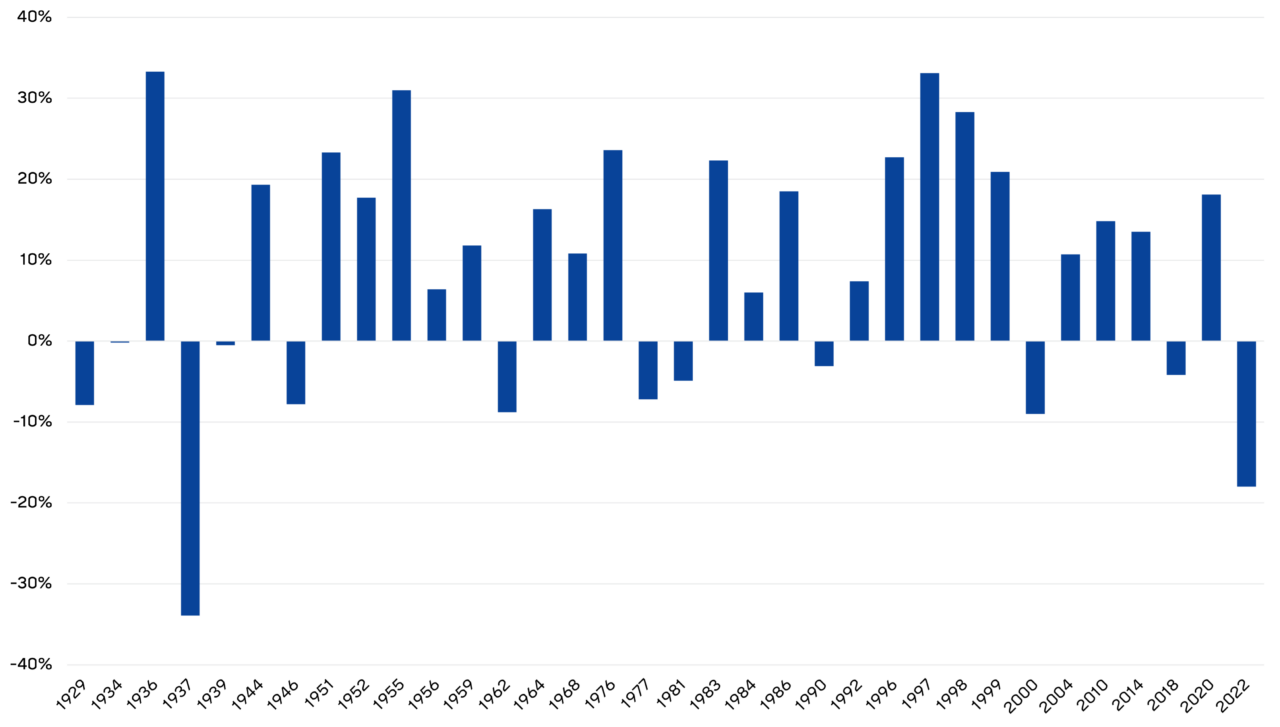

Between 1928 and 2022, the S&P 500 has delivered a return of more than 20% 34 times. The market delivered positive returns the following year 22 times (65% – see chart below).

S&P 500 Returns Following a 20% Plus Year

ST. LOUIS TRUST & FAMILY OFFICE

A mere glance at the above chart shows that investing after strong return years was profitable. The market data confirms this: the average return in the years following a robust up year was 9.0% — not far behind the S&P 500’s average annual return since 1928 of 9.8%. And the median return in those following years was 11.1%.

What To Do With My 2024 Prediction

My prediction that the stock market probably will be up but might be down may seem useless, but it’s not. It provides a rough idea of what the market will do next year, which is the best anyone can do. If you are sitting on excess cash, it tells you that the odds favor going ahead and investing. Yet it also tells you that if you receive a once-in-a-lifetime influx of money from selling a business, you might want to invest over time because the market might be down.

In sum, making investment decisions based on a nonspecific yet correct prediction is better than acting on specific but hopelessly wrong ones. Shut off the noise of what may (or may not) be happening in the economy and geopolitics and resist listening to investment experts’ predictions of the future.