I discussed the allure of venture capital investing and how performance success resembles a power law (a handful of investments drive the majority of returns) in a previous Sound Smart. This means that a small sample of venture capital funds capture an outsized share of venture capital success. While it would be great to have an investment time machine to go back and invest in the select group of top-performing funds, we investors must make decisions based on what we know today.

Numerous variables are considered when evaluating a venture capital fund’s attractiveness and performance potential, including the background of its people, the fund’s past performance, the industry in which it invests, which rounds it targets, and its strategy for creating value. The most measurable metric is the fund’s past performance, and because of the objective nature of past returns, a fund’s track record tends to have an outsized influence on the decision to invest. But is that wise? Do a fund’s past returns tell us anything about its potential future returns?

Performance Persistence

The question of whether past performance is predictive of future returns is answered by looking at an investment manager’s persistence, which is the correlation between the performance rankings of a fund in an initial period compared to rankings in the subsequent period. If managers tend to repeat their ranking from period to period, then they have performance persistence.

Investment managers who trade publicly traded stocks do not display persistence – strong returns in one period do not correlate to strong returns in the next period. Is the same true of venture capital funds? Is the past performance of a venture capital fund an indicator of future fund success?

If we measure persistence on a relative basis and define success as being in the top quartile of performance for a group of venture capital funds raised in a particular fundraising (vintage) year, then the answer is “Yes.”

Quantitative Evidence

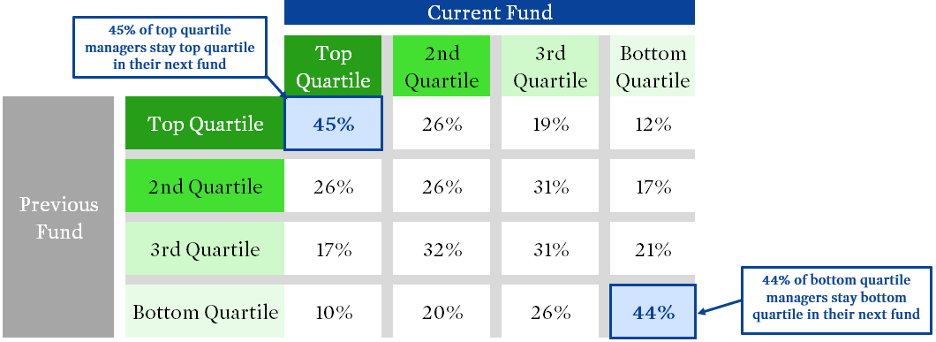

A recent study published by the University of Chicago Booth School of Business assigned about 1,400 venture capital funds to performance quartiles and compared their rankings from one fund to the next, as shown in the table below. (An example would be ranking ABC Manager Fund I as a “previous fund” and then ranking performance on the “current fund,” ABC Manager Fund II.)

Robert S. Harris, Tim Jenkinson, Steven Kaplan, and Ruediger Stucke

The results are hot indeed – 45% of top quartile managers remained top quartile in their subsequent fund. This outcome is better than pure chance, which would result in 25% odds of each quartile. And top quartile funds were in the top half 71% of the time (e.g., 45% + 26%). Similarly, the bottom quartile performers remained in the bottom quartile for their next fund 44% of the time, again greater than the 25% odds that chance would dictate.

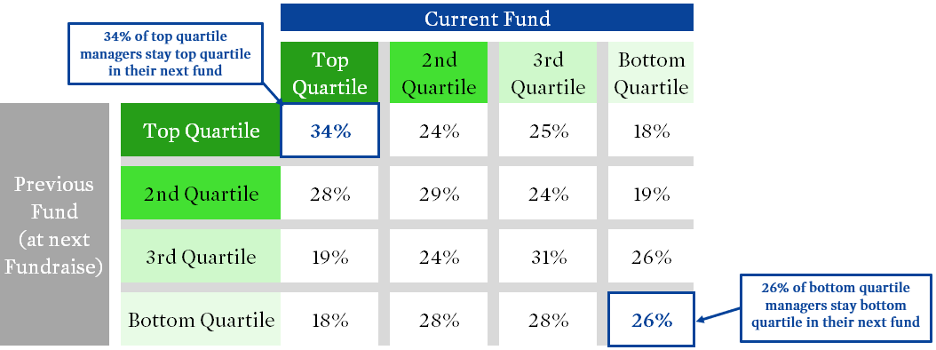

A little wrinkle here: venture funds tend to have long lives, often spanning more than 12 years from initial investment to termination. Venture firms usually raise their next fund during the life of their prior fund – typically 3-4 years after inception. The challenge is you don’t know a fund’s final performance ranking when deciding whether to invest in the next one. Dang.

But wait! The study goes further to account for this reality, focusing on prior fund performance while fundraising for the next fund. These researchers thought of everything! The results are somewhat similar. Performance persistence still exists for VC managers using the information available during fundraising for their next fund, but it is less robust than the results using final return information.

Robert S. Harris, Tim Jenkinson, Steven Kaplan, and Ruediger Stucke

The researchers conclude there is strong performance persistence for VC funds. However, we caution against using past performance as the sole criterion for evaluating an investment opportunity. Yet, unlike with public stock managers, prior returns provide valuable data in evaluating venture capital managers. Of course, venture capital investing is risky, and many factors beyond prior performance play into whether a fund will succeed. While relying on track record sounds like a nice shorthand, investors should consider the myriad factors at play, including luck.