The first question on the University of Michigan’s Survey of Consumers questionnaire asks, “Would you say that you (and your family living there) are better off or worse off financially than you were a year ago?” The survey traces its roots back to the 1940s and has provided a pulse on consumers and how they feel about the economy, personal finances, business conditions, and buying conditions. Consumer sentiment is considered a leading indicator of economic trends. Optimism should breed further consumption and vice versa. Do trends in consumer sentiment have any predictive power in how the stock market will perform?

The premise of sentiment being a factor in investment trends seems reasonable. If consumers are optimistic about their financial future and feel confident about the economy, they will be more likely to invest in the markets. The market itself is a leading indicator and measures the collective future outlook of each of its representative companies. If consumers, whose spending represents the largest component of GDP, feel good, then the market should stand to benefit.

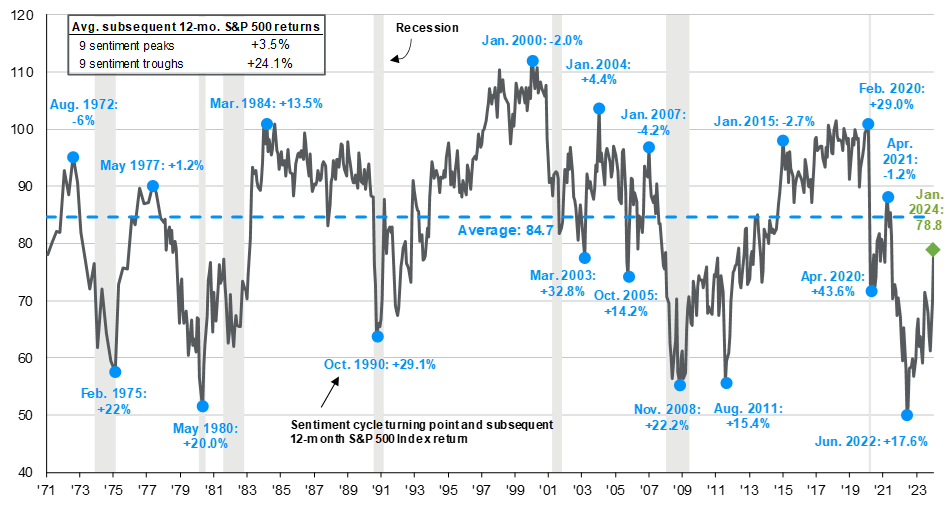

The following chart is from J.P Morgan’s Guide to the Markets and shows the statistical reading of the University of Michigan’s Consumer Sentiment Index from 1971. It also reveals the S&P 500 Index performance after peaks and troughs.

Consumer Sentiment Index and Subsequent 12-Month S&P 500 Returns

Interestingly, the sentiment troughs preceded strong market gains, while the peaks had a more muted upside. Investors would’ve been better off allocating to the market when consumers perceived their financial situations as less desirable, compared to points where optimism reigned supreme.

Successful investing involves being disciplined rather than attempting to predict a future that is predictably only one thing: uncertain. The best investors don’t try to keep their pulse on consumer sentiment; they disconnect sentiment from behavior. Don’t let your gut tell you otherwise.