Investing in actively managed equity funds can often feel like navigating a complex maze, especially when considering the ever-changing landscape of fund performance. Investors are prone to finding investment managers who have performed well and assume it will persist. But do past solid results suggest that future performance will also be strong? As I’ve previously written, performance persistence is evident in venture capital, yet studies find it is absent from public equity fund investing. S&P Global’s recently published Persistence Scorecard provides interesting data about how past top-performing investment managers fare in future periods.

A primary conclusion of the S&P report is that unless you invest with Bernie Madoff, you cannot expect top-quartile performance every year. The chart below shows the proportion of 2019’s top-quartile funds that remained top-quartile in the following years. The data shows that only 2.8% of funds delivered top-quartile performance in the following two years, and zero funds were top-quartile by the third year.

The lesson is that consistently delivering annual top-quartile returns is nearly impossible.

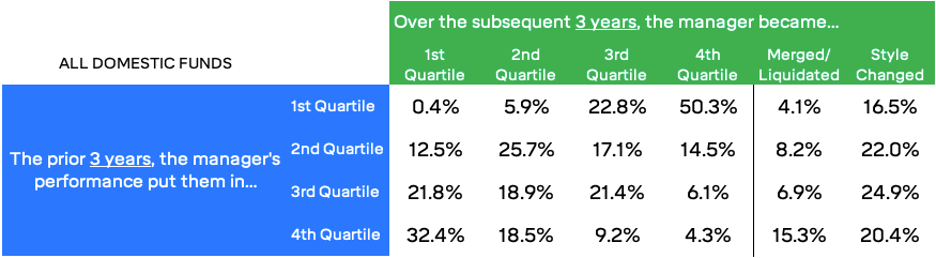

Looking over more extended periods tells a similar story. The following table ranks managers into performance quartiles based on three years and shows how they performed over the subsequent three years.

There was no performance persistence among the top-quartile managers. Being a top performer in a prior three-year period was highly correlated with being a poor performer in the following three years. The data shows that less than 1% were able to retain their top-quartile ranking, while most ended up near the bottom on a relative basis. Interestingly, the worst relative performers over the prior three years had the best odds of becoming the best in the following three years. But they had the highest rate of being merged or liquidated.

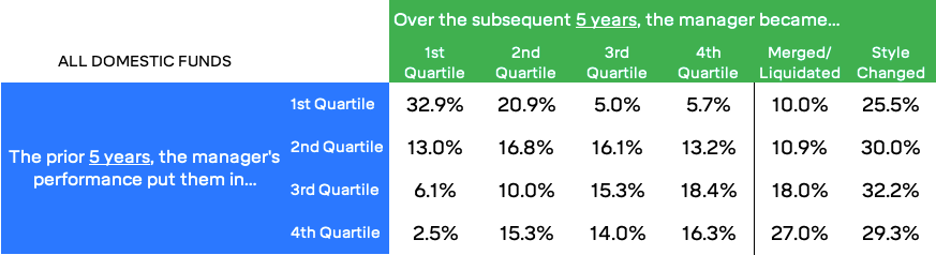

Extending that same analysis over 5-year blocks of time supports a lack of persistence. Still, it provides one contradictory result – top quartile managers retained that spot 33% of the time in the subsequent 5-year period, better than what random odds (25%) would dictate.

The S&P Persistence Scorecard shows that public stock investment managers have no persistence over the short term (annually over three years). This can be attributed to changing market conditions, styles coming in and out of favor, competition, randomness, luck, and reversion to the mean. The five-year results show some persistence with top managers repeating their strong performance a bit more than chance would dictate.

Investors must understand and accept the reality of equity mutual funds’ lack of performance persistence. The main takeaway is to avoid chasing performance when picking active managers. It’s been shown to lead to underwhelming results. Instead, take a longer-term approach in assessing a manager, seek those with lower fees or eschew them all together and invest in market-index ETFs.