A “sputnik moment”* occurred weeks ago when an obscure Chinese AI startup called Deepseek released an open-source AI model that reportedly matched or exceeded the capabilities of U.S. competitors, like ChatGPT, at a fraction of the cost. While this news directly affected only a handful of AI tech companies, its impact contributed to a 1.5% decline in the broader S&P 500 Index that day. This outsized market reaction highlights a crucial characteristic of today’s market: unprecedented concentration. The major AI-focused tech companies – Microsoft, Apple, Nvidia, Google, Amazon, and Meta – now represent the top six positions in the S&P 500 index, with a combined weighting of 30%. This concentration gives these companies significant influence over the broader market’s performance. Is this a good or bad thing? Should investors be concerned about the level of concentration in the U.S. stock market?

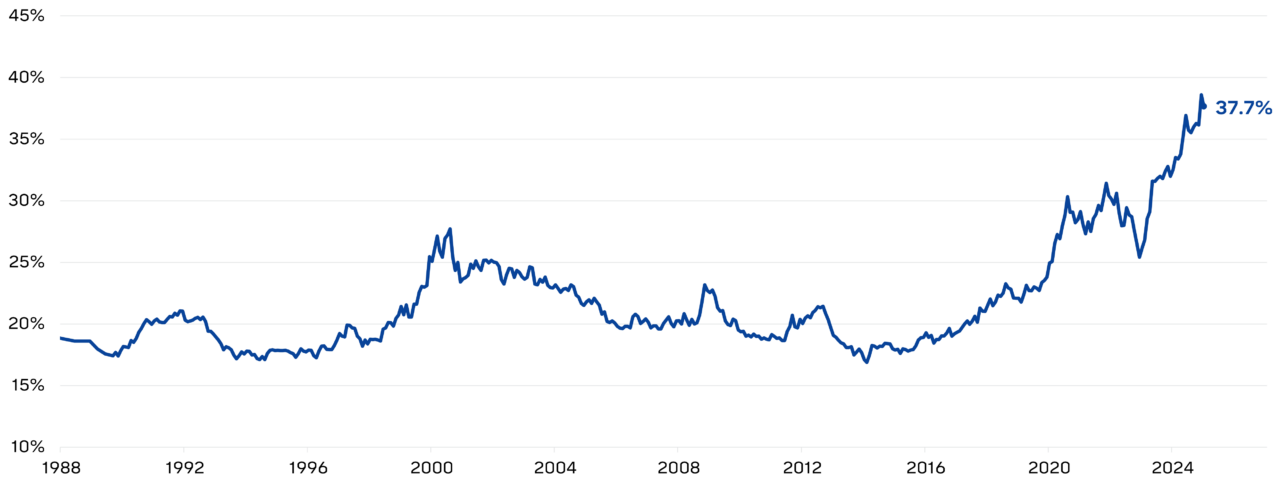

A historical look extending the weighting out to the 10 largest stocks in the S&P 500 shows that the market has become increasingly concentrated, now accounting for 38% of the entire index weight.

Top 10 Weighting in S&P 500 Index

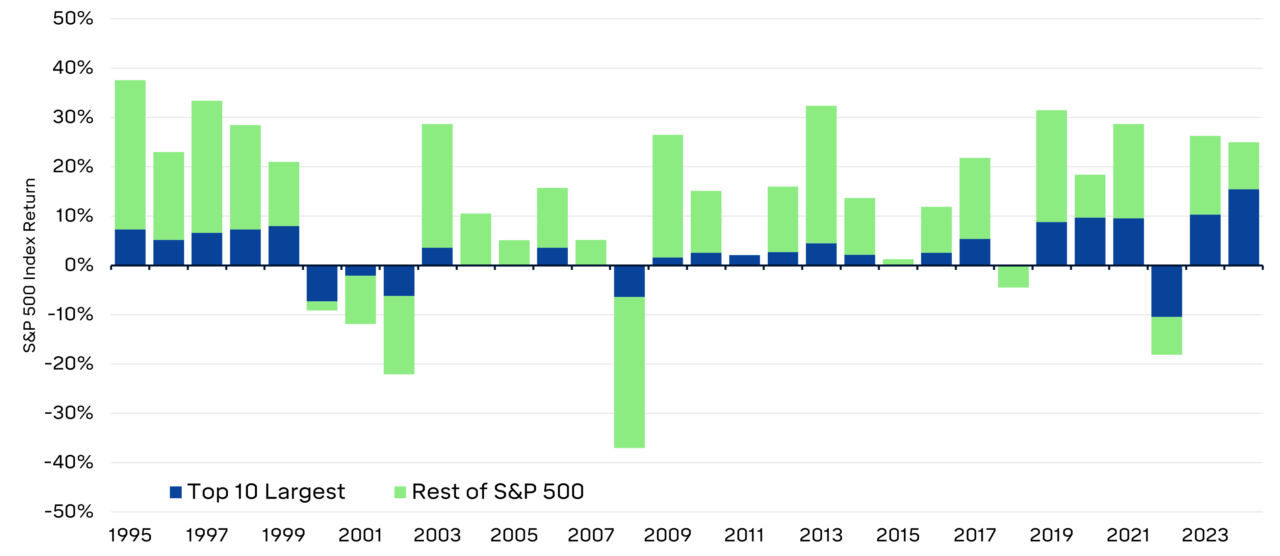

This concentration means that movements in these 10 stocks can dramatically sway the entire index’s performance. The below chart shows how the Top 10 stocks drove returns in each calendar year versus the other 490.

Contribution to Annual S&P 500 Return

Over the last several years as the weight of the top 10 stocks grew within the index, so did their contribution to performance. In 2024 alone, more than 60% of S&P 500’s generous annual return of 25% was attributable to the 10 largest stocks. While this might seem alarming at first glance, it’s worth noting that market concentration isn’t a new phenomenon. Throughout history, a small number of dominant companies have driven a disproportionate share of market returns.

However, analyzing market concentration in isolation can lead to oversimplified conclusions. There’s no magic number that signals when concentration becomes “too high” or automatically indicates market vulnerability. The underlying factors matter: Are these companies generating substantial profits? Do their growth prospects justify their market positions? Are their valuations reasonable given their earnings potential?

But here’s the key insight for investors: Rather than fixating on market-level concentration and the headlines it generates, your focus should be on your own portfolio’s exposure and diversification strategy. A well-balanced investment strategy considers not just exposure to a few dominant stocks but also allocations across different asset classes, sectors, and geographies. This could include having international stocks, small cap stocks, managers or index funds that have lesser weightings to the top companies. Even if a specific market appears concentrated, an investor with a diversified portfolio can mitigate risks by holding assets that perform differently under various economic conditions. This broader perspective on diversification helps ensure long-term stability and reduces vulnerability to that next “sputnik moment.”

*A sputnik moment references back to the shock in the US when the Soviet Union launched the sputnik satellite. The term is metaphorically used to describe a wake-up call when realizing one is falling behind in a crucial area.