The New York Stock Exchange (NYSE) has operated a trading schedule from 9:30 a.m. to 4 p.m. ET, Monday through Friday, since 1985 (with a varied schedule going back since its inception). Each weekday, the ceremonial bell starts and ends the trading period during which institutional and retail investors buy and sell U.S.-listed stocks. But most market-influencing news occurs outside of NYSE trading hours, the most notable being corporate earnings and the bulk of economic data released from the government. These items impact stock prices, but investors can’t immediately access a robust marketplace to act on them. This begs a question: Would it benefit investors if the U.S. stock market were open 24/7?

It’s an intriguing question that the NYSE is pondering. They recently sent out a survey to market participants exploring the potential benefits of trading stocks around the clock. With investors from all over the globe increasingly participating in the U.S. market, the case for broader trading hours is compelling. After all, other markets, including US Treasuries, major currencies, and cryptocurrency, already operate 24/7. The SEC is also considering an application for a start-up exchange to operate on a 24-hour basis. Could this extended trading period provide an opportunity for better returns? One way to approach this question is to examine how the market performs when it’s closed vs. open.

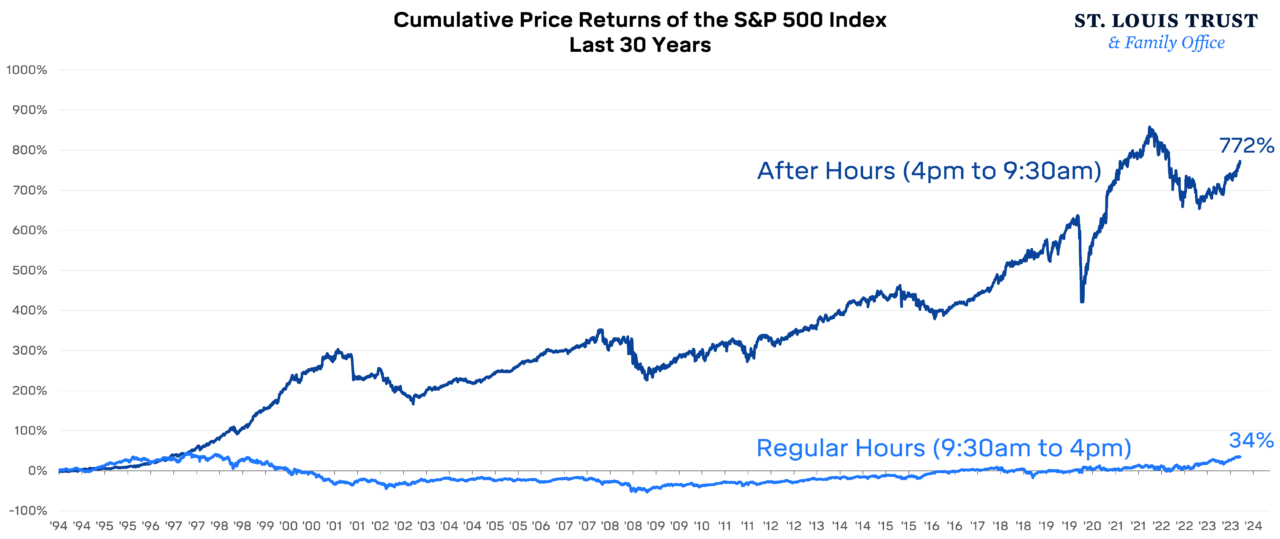

The below chart shows the cumulative price return for the S&P 500 over the last 30 years in two distinct scenarios: If you bought an S&P 500 index ETF at the open and sold at the close each day (“regular hours”) vs. if you bought at the close and sold at the subsequent open (“after hours”).

It turns out that the S&P 500 performs considerably better when the market is closed! For most of the last 30 years, the market’s cumulative performance during normal trading hours has been near flat. Whoa.

But before we collectively storm the gates of the NYSE after hours and demand they open, it’s important to reflect on some practical points. First off, buying the market at each close and selling the following open is an arduous, impractical, and potentially expensive exercise. Conversely, investors aren’t continually buying on open and selling on close either. These performance paths are largely hypothetical, if not entertaining to think about. However, this underscores a point where the bulk of returns occurred when investors were absent. A valuable lesson in removing yourselves from the equation.

If the U.S. stock market does indeed transition to a 24/7 model, investors should not feel compelled to take advantage. Introducing a 24/7 stock market could create unnecessary urgency, leading investors to engage in more market timing, which research shows is not beneficial. Investors benefit from spending more time in the market, not more effort timing it.