What just happened?

Last Friday, Silicon Valley Bank (SVB), the 16th largest bank in the U.S., was taken into receivership by the FDIC after making several announcements regarding concerns about a significant increase in withdrawals and its need to liquidate assets to cover those withdrawal requests. Over the weekend, Signature Bank, the 30th largest bank in the U.S., had its charter revoked by the state of New York and was sent into receivership as well.

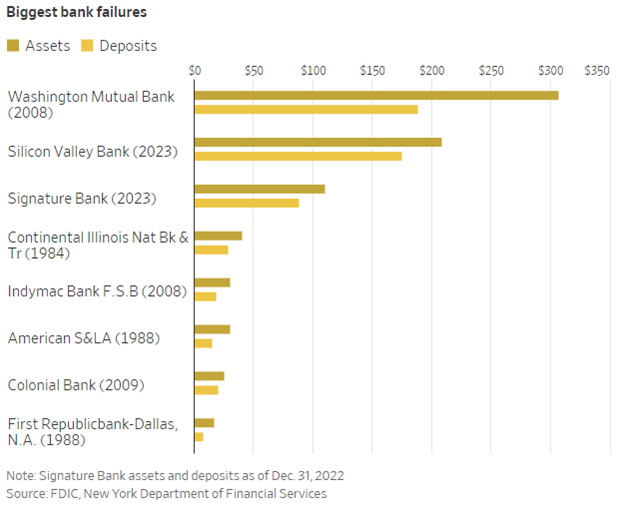

These two bank failures mark the 2nd and 3rd largest bank failures in U.S. history, trailing only the failure of Washington Mutual Bank in 2008.

On Sunday, the FDIC, Federal Reserve, and Treasury Department announced that all depositors at these two banks would have full access to their funds on Monday. The assets of these banks will be used as collateral by the FDIC to provide liquidity to cover the withdrawals of all account holders.

This scenario resembles what many of us remember from the Global Financial Crisis in 2008, with bank failures and significant fear about the future of the banking system. Today, however, the concern is not with the asset quality of these failed banks but rather a mismatch between the banks’ short-term liabilities and longer-term assets. The government has now stepped in to bridge this mismatch and provide liquidity for all bank depositors to access their funds.

Schwab Specific Concerns

St. Louis Trust & Family Office clients have significant assets held at Charles Schwab. From a client perspective, assets held at Schwab can be thought of in two categories: (1) custodied assets and (2) bank deposits.

Stocks, ETFs, Mutual Funds, and Bonds held at Schwab are not on Schwab’s balance sheet. For these assets Schwab merely acts as custodian – it is a record-keeper. Other than potential administrative hassle, these assets would not be affected in the unlikely event that Schwab fails. Schwab confirmed this fact earlier today stating; “Investments at Schwab are held in investors’ names at the Broker Dealer. Those are separate and not comingled with assets at Schwab’s Bank.” You can read Schwab’s full statement here.

The other category of assets, bank deposits, are treated differently. Cash at Schwab is held by Schwab Bank and is a liability on its balance sheet. Like all banks, the first $250,000 is covered by FDIC insurance, but any excess amount is uninsured. If Schwab were to fail, amounts over $250,000 are potentially at risk. Schwab Bank is the 8th largest bank in the U.S., and we’d expect the FDIC to protect depositors as they did with Silicon Valley Bank and Signature Bank.

Notwithstanding the likelihood of FDIC protection of uninsured amounts, a recommended action is to move cash in excess of FDIC coverage into a cash equivalent product called a “position-traded money market fund.” A position-traded money market fund is a mutual fund that invests in ultra-short-term securities (usually with less than a 7-day maturity). Importantly, these funds are like stocks and mutual funds – Schwab acts as the custodian, and they are not held on Schwab Bank’s balance sheet. They are slightly less liquid than cash, as it takes a day for a sale trade to settle.

Our team is analyzing our clients’ cash balances and will be reaching out directly to clients about whether any cash should be moved to position-traded money market funds.

What does tomorrow look like?

The full implications of these circumstances, from the speed of the run on these select banks (perhaps aided by group chats and social media), to the speed and completeness of the rescue, are still unknown. We are actively monitoring this situation as it progresses and staying on top of developments from all corners of the financial markets.

We cannot know what tomorrow will look like, but with the steps taken by the Federal Government, we are confident that depositors should not be concerned about accessing their funds in the event of other bank failures.

The best approach is to maintain our core investment behavior tenets: plan for the long-term and avoid making hasty decisions when markets are in turmoil.

Please reach out directly to your client team with any questions or concerns.