Just two years ago, cryptocurrency mania swept the globe. It dominated Thanksgiving dialog, with some relatives asking, “What are ‘NFTs?’” and others telling everyone within earshot that they have hefty gains in <insert random crypto coin here>. Celebrities endorsed crypto trading platforms, and crypto firms’ names popped up on sports stadiums nationwide. Friends asked whether they should buy Dogecoin, the inherently worthless coin created as a joke. In hindsight, it was a classic bubble fueled by the euphoria surrounding quick riches and the fear of missing out. (To be fair, many people thought the whole crypto thing was ridiculous at the time, but who wanted to listen to those buzzkills?!)

Today, we are witnessing a bookend to the crypto hype that captivated us all. The iconic figure that embodied the meteoric rise of crypto, Sam Bankman-Fried (also known as SBF), was recently found guilty of stealing from customers of the now-bankrupt FTX cryptocurrency exchange. FTX’s rival cryptocurrency exchange, Binance, is now in trouble. Unfortunately (or should I say, deservedly), the CEO of Binance has recently stepped down from his role and is pleading guilty to money laundering. The SEC has also filed a lawsuit against Binance for allegedly inflating U.S. trading volumes and not registering as a futures commodity merchant.

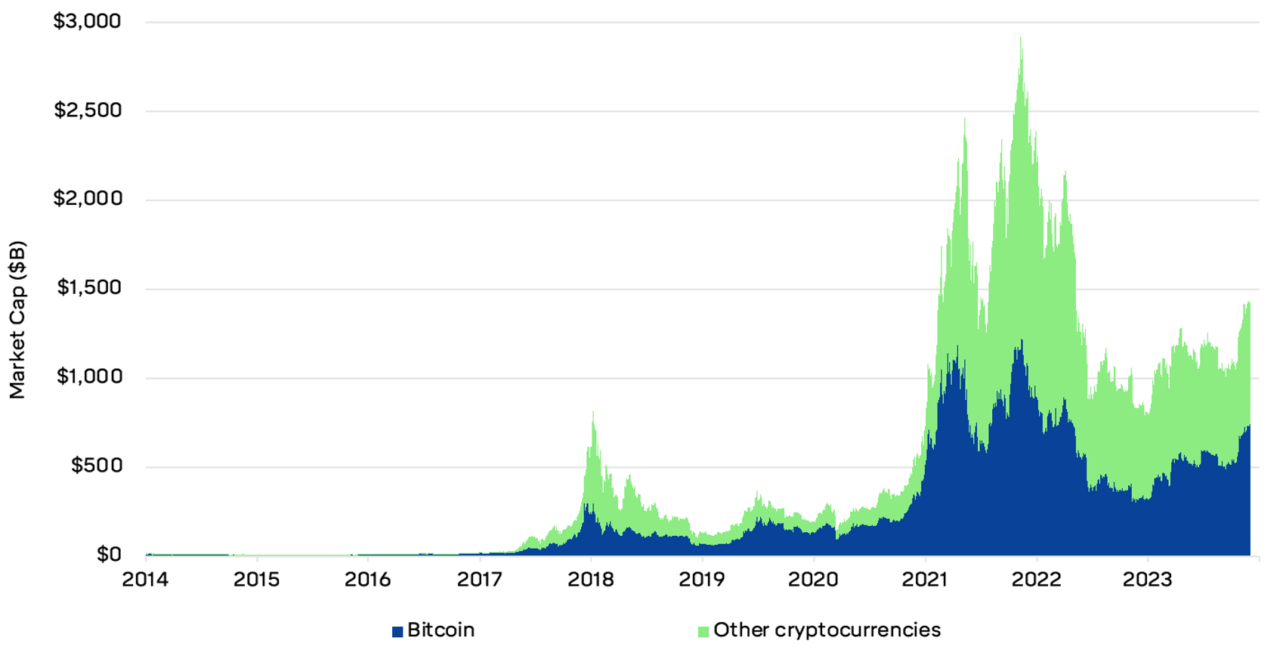

Given these events, one would assume that the enthusiasm for and adoption of cryptocurrencies has reached a new low. But that isn’t the case at all. Below is the total market value of cryptocurrencies going back to 2014.

Market Capitalization of Cryptocurrency

Date Source: Coinmarketcap

It’s fascinating to recall that cryptocurrencies were worth nearly $3 trillion (that’s a trillion with a “t”!) during the height of the bubble in 2021. But what’s perplexing now is crypto’s current rise to a nearly $1.5 trillion value today. Wasn’t this “fake money” supposed to die off once FTX imploded?

There may be numerous reasons for crypto’s resilience, but the looming SEC approval of a Bitcoin Exchange-Traded Fund (ETF) is a likely suspect. Amid the backdrop of the U.S. judicial system coming down hard on crypto evangelists and market operators, the SEC is on the verge of granting (and implicitly endorsing) several new ETFs that can hold actual bitcoin (not to be confused with the bitcoin ETFs operating currently in the U.S. that only hold bitcoin futures contracts). Having a bitcoin ETF managed by BlackRock would appeal to the $30T in financially-advised assets that had collectively shied away from custodying bitcoin themselves or avoided it altogether.

Does an SEC-approved investment vehicle make investing in Bitcoin (or any cryptocurrency) safer? No. It doesn’t reduce the risk of underlying crypto fundamentals (assuming there are any, haha). Cryptocurrencies are speculative assets, and investors shouldn’t buy cryptocurrencies unless they can tolerate the volatility and its emotional roller coaster. As with any ETF, it will not serve as a seat belt but rather a ticket to ride.