“A national debt, if not excessive, will be to us a national blessing.” – Alexander Hamilton.

This statement by the first Treasury secretary may feel overly optimistic today as the national debt continues to climb. The federal debt the public holds currently sits at $27.5 trillion (with a “T”!), with recent Congressional Budget Office (CBO) projections showing that level climbing above $50T in ten years.* Yikes!

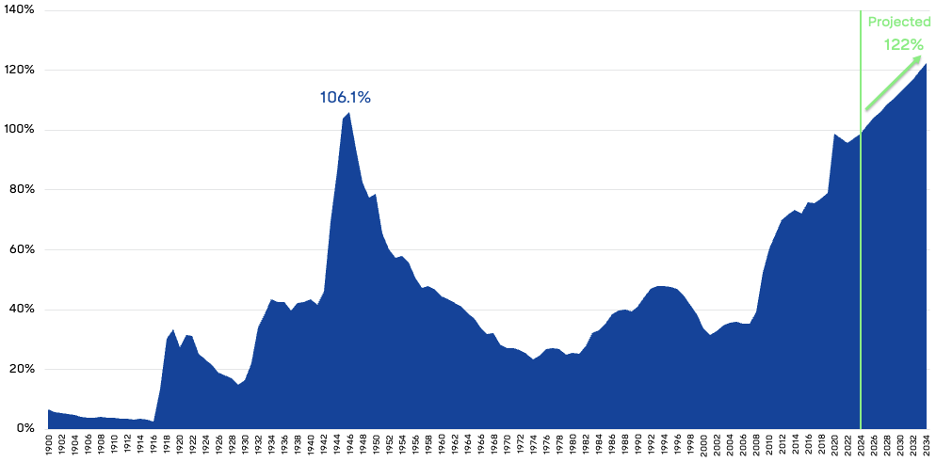

Currently, the national debt is about equal to the size of the economy (as measured by the gross domestic product or GDP), and the CBO projects that it will be 122% of GDP in 2034. These numbers are alarming. How worried should an investor be? Is there a specific level of debt-to-GDP that is too much for the U.S. to handle?

The debt-to-GDP ratio measures a country’s debt relative to its economic output and, therefore, its ability to repay it. A higher ratio suggests a higher risk of default.

Federal Debt held by the Public (% of GDP)

Looking back through history provides some context to when countries get in trouble from a debt standpoint. There have been hundreds of defaults and debt restructurings involving the debt of other countries over the past 150 years. Most cases involved tumultuous political situations, wars, revolutions, or civil conflicts that made governments not want to pay. Defaults and restructurings of the last several decades reflected subtle interactions between domestic economic policies and economic shocks. Despite a storied history of debt struggles, what unfortunately remains elusive is a consensus by economists on what specific debt-to-GDP level triggers such dangers.

But maybe that isn’t all that surprising. Economies are incredibly dynamic; fiscal policies change, and thus, predicting outcomes becomes near impossible. The U.S. benefits from moderate economic growth, strong and independent institutions, a desirable and globally integral currency, and an unwavering investor demand for its debt. These elements continually mitigate any perceived threats of default.

While there is justifiable cause for alarm, that doesn’t necessitate an immediate call to action for investors. Yet, investors can structure their portfolios with an eye to the pressure the federal debt puts on the economy. Because tax increases likely will be necessary to help service the debt, investing in tax-exempt and tax-efficient investments is essential. Next, diversifying internationally may mitigate the impact of a worsening fiscal situation on the U.S. equity markets. Combining these elements with the discipline to disregard negative news reports is a solid investment strategy in the face of the mountain of debt.

*There are multiple ways to measure how much the federal government owes, and these figures seem to be interchanged in many articles and opinion pieces. For instance, the national debt comprises ‘debt held by the public’ (at $27.5T) and debt held by the government itself (at $7.2T). The former is owed to any person or entity that isn’t a federal government agency. The latter is debt that the government essentially owes itself – examples being federal programs like Social Security and Medicare that collect revenues and invest in Treasury debt for their trust funds.