All three of my kids were fascinated by dinosaurs at one point. We read books on them, looked at fossils, and (obviously) watched Jurassic Park. However, we have yet to consider buying an actual dinosaur skeleton. Ken Griffin, the billionaire head of hedge fund and financial services firm Citadel, took a different approach and recently purchased skeleton for $45 million. Impressive! (This will go great with his recent purchase of an auctioned first-edition copy of the U.S. Constitution*)

Ken is among a growing list of billionaire investment titans buying eclectic, trophy-type assets, including luxurious real estate, sports teams, and the occasional fossil. How did these investment firm owners become so wealthy? A combination of talent, rigor, leadership, persistently good investment performance, and the high fees charged on their products. The fees charged are worth exploring from an investor’s standpoint. What are the typical fees investors pay to access investment strategies? And should they pay them?

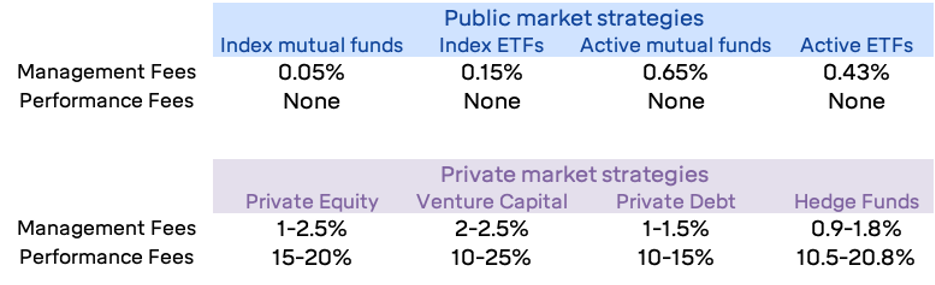

The chart below illustrates the average fees charged on investment strategies across the public and private market landscape. Management fees are the base fee charged by the investment manager on the value of the investment, while performance fees are a percentage of the gains produced by a fund over a hurdle rate (often 6-8%).

Illustrative view of fees charged on investment strategies

Note: Public market strategy fees are based on the asset-weighted average for 2023, compiled using Morningstar data. Private market fees are presented as ranges from various fee surveys performed by institutional investors.

Access to public market strategies is widely available, and investors pay management fees to become shareholders. The good news is that these fees continue to trend lower.

Private market funds (ex., private equity, venture capital, real estate, etc.) are generally structured as limited partnerships or LLCs. Investors need to qualify to invest in these partnerships and pay various fees to the manager. Private market fund managers charge their investors a management fee, typically 1-2%, and a performance fee, known as carried interest, that can range from 10%-25% of any appreciation in the investment. A handful of renowned hedge funds charge upwards of 5% management fees and 50% on performance (exception, not the norm). Thus, investment firms that successfully raise large amounts of investor capital and perform well are likely to reap substantial fee windfalls for their owners.

Understanding the fees associated with different investment strategies is crucial for making informed investment decisions. While public market strategies offer lower fees, private market strategies can justify higher fees with the potential for superior returns. As an investor, it’s essential to assess whether the fees charged align with the expected performance and expertise of the investment manager. Ultimately, the goal is to ensure that the investment gains benefit you, the investor, rather than being eroded by excessive fees. With the right balance, you might find yourself in a position to indulge in your own ‘trophy’ purchases, perhaps even a dinosaur skeleton!

*He outbid a group of cryptocurrency investors that crowdfunded a considerable amount. I was part of it…and we (all 17,000 of us) were so close to winning! I’m still a little bitter.