Most of the factors that affect a portfolio’s value over time are beyond an investor’s control, such as global geopolitical events, economic conditions, interest rate movements and movements of the markets, just to name a few. Fees and the taxes generated by a portfolio, however, are mostly within the control of the investor and yet are often overlooked.

At St. Louis Trust & Family Office, we believe that fees and taxes should be a primary focus of portfolio construction and investment selection. In fact, one of the four cornerstones of our investment philosophy is “fees and taxes matter.” The following is a look at how we view investment taxes and how our perspective influences the advice we give.

Why Are Taxes So Often Ignored?

While most investors and advisors pay attention to management fees, few are as diligent about investment taxes. There are several reasons many investors tend to ignore taxes resulting from their investment decisions:

- First, taxes are paid only a few times a year and often from a bank account separate from the investment account, allowing investors to mentally separate their investments from their tax expenses.1 Conversely, management fees are paid from the same account as the investment and reduce net returns reported to the investor, so they receive continual attention.

- Second, taxes generated by any given fund or investment account can be difficult to quantify. Taxable investment income in the most basic investment account is often a mix of short term and long term gains and losses, dividend income, and interest. In addition, accurately quantifying after-tax returns requires knowledge of a client’s tax rates, which are linked to client-specific investment and non-investment factors such as earned income and deductions. Tax rates also change periodically with changes in legislation, making it more difficult to calculate after-tax returns over long time periods.

- Third, because taxes and after-tax returns are difficult to compute, presenting this information is not industry standard. Since 2002, the SEC requires mutual funds to report after-tax returns, but mutual funds are often only a portion of each client’s total investments. In addition, these returns are often presented in the fine print and require the investor to compute the tax cost of the investment by comparing pre-tax to post-tax returns. Without a quantified “tax cost” associated with each investment decision or an entire investment portfolio, clients and advisors are understandably tempted to avoid the topic. They often turn their focus to stated management fees and stop the conversation there.

Why Are Taxes So Important?

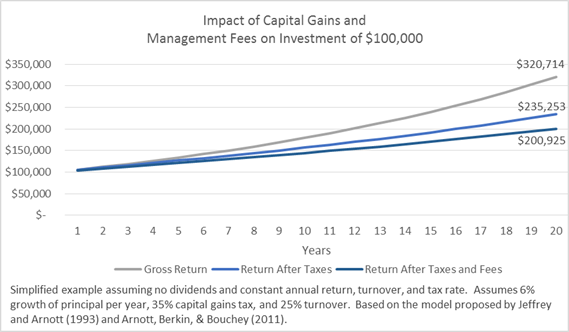

Despite all of the above hurdles, we make a concerted effort to manage our clients’ investments in a tax-efficient manner. We believe taxes are just as important as investment fees and, quite possibly, more important. A client’s annual tax bite from investments can easily be a larger expense as a percentage of portfolio assets than the cost of investment fees. In general, taxes negatively impact returns by an average of 1 to 3 percentage points per year for actively managed funds, a performance hurdle that is difficult to overcome by outperforming the benchmark.2 (Add in active management fees, which can be over 1%, and it’s easy to see why fees and taxes matter.) The below chart shows how capital gains taxes and management fees can eat away at $100,000 invested over 20 years.

How Can We Help Our Clients?

We have two major roles in helping clients invest in a tax-efficient way. First, we choose and recommend funds that are relatively tax efficient or stand a reasonable chance at providing enough alpha to the investor to compensate for the tax drag. The majority of our clients’ assets are placed in tax-efficient, low-fee investments because finding these types of investments is more of a sure bet than finding investments that will consistently outperform the benchmark plus taxes plus fees.

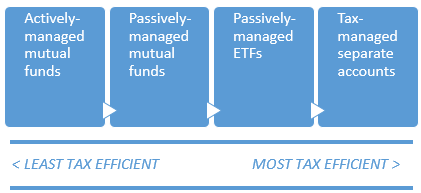

Some factors that influence tax efficiency are investment turnover, passive vs. active management, fund structure (separate account vs. mutual fund vs. ETF), and deliberate tax-loss harvesting. In general, a separate account with a deliberate tax-loss harvesting mandate is the most tax-efficient type of investment and high turnover, actively managed mutual funds can be the least tax-efficient. We recommend investments across the full spectrum in a manner that best suits each client’s investment goals and objectives, always keeping in mind the tax trade-offs inherent in the choice of funds.

Second, over and above choosing individual funds, we make recommendations regarding asset allocation, timing, and estate planning that can dramatically impact a client’s taxes paid. Some examples of tax-sensitive decisions are deferring gains to benefit from lower long-term capital gains rates, selling high-cost lots to minimize gains realized today, and considering clients’ unique situations such as years with unusually high or low income or the potential for a future step-up in cost basis.

There are plenty of reasons we could be tempted to ignore taxes. We know that our tax conversations with clients will never be repeated at the evening’s cocktail party; taxes are often the last things clients want to talk about. And because of the interplay of so many factors at once, we’ll never be able to truly quantify for an individual client the impact of making tax-efficient decisions. Plus most of our clients’ savings from being tax-efficient comes from dozens of small decisions that add up throughout a year rather than one big planning idea. Despite all of these reasons we might avoid the topic, we consider it our responsibility to pay close attention to the tax implications of our advice. As summarized in our investment philosophy, “fees and taxes matter.”

1 Geddes, Patrick. “Adding Insult to Injury: The 2015 Tax Penalty for Active Management.” Aperio Group, LLC. Creative:MINT, 2016. Web. 19 Jul. 2016.

2 Arnott, Robert D., Andrew L. Berkin and Paul Bouchey. “Is Your Alpha Big Enough To Cover Its Taxes? Revisited.” Research Affiliates, LLC. Research Affiliates, Jan. 2011. Web. Jul. 2016.

Jeffrey, Robert H., and Robert D. Arnott. “Is Your Alpha Big Enough To Cover Its Taxes? The Active Management Dichotomy.” The Journal of Portfolio Management 19.3 (1993): 15-25. Print.