As I’ve previously written, the data centers that power A.I. require a ton of electricity, raising questions about where all that additional power will come from.

Nuclear power might be a partial solution to this problem, as signaled by recent news that Microsoft is collaborating with a utility company to reopen a decommissioned nuclear reactor at the infamous Three Mile Island—the site of the worst nuclear accident in U.S. history (a vivid memory for some). Whoa! And this isn’t an isolated case: other data center operators are also looking to secure energy from nuclear sources. Does this signal a revival for the long-dormant trends in U.S. nuclear generation?

The renewed interest in nuclear energy to support growing electricity demand, especially from A.I., marks a pivotal moment in its favorability arc. Public opinion on nuclear energy has become more favorable, as it’s been increasingly seen as a clean source of reliable power. After years of increasing regulation following the Three Mile Island disaster, the U.S. government shifted to supporting nuclear power again in the mid-2000s by offering financial incentives like loan guarantees and subsidies, while more recent efforts are pushing for the development of advanced reactor technologies.

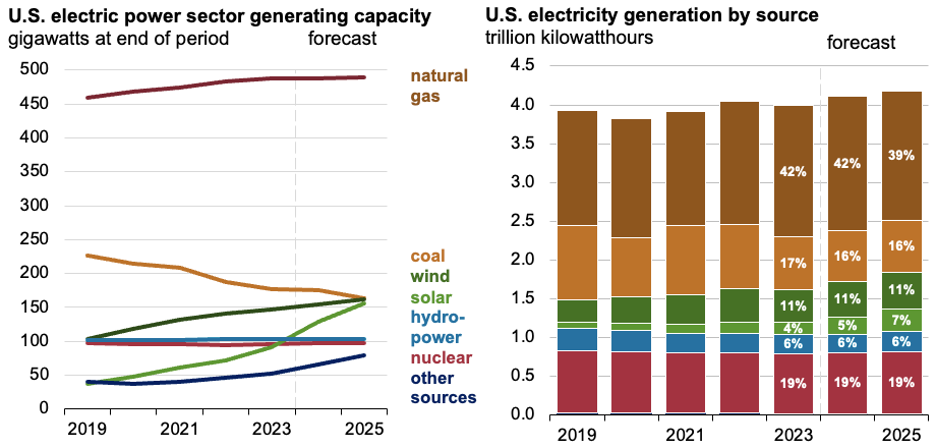

With rising favorability and the huge electricity demands of A.I., what does the future look like for nuclear energy generation? According to the U.S. Energy Information Administration’s (EIA) latest energy outlook, nuclear generation is expected to show modest growth. Still, its share of total U.S. electricity production will likely remain flat over the next couple of years.

This forecast might seem underwhelming for those hoping for a swift resurgence of nuclear power. However, several factors explain why nuclear power can’t simply be ramped up overnight and become the go-to solution:

- Existing nuclear plants already operate at near-maximum capacity, with an average capacity factor above 90%. These plants have historically provided reliable base-load power, but there’s little additional output to squeeze from them.

- Restarting decommissioned reactors is no easy feat. It can take years, large capital investments (including subsidies), and overcoming significant regulatory hurdles. The number of reactors that could feasibly be brought back online is estimated to be in the single digits.

- Building new reactors is an extraordinarily complex and costly endeavor, particularly in the U.S. It requires billions in investment, navigating a complicated regulatory landscape, securing supply chains, assembling the necessary expertise, and constructing massive, highly technical facilities.*

- Could smaller reactors be a solution? Yes! Advances in small modular reactors (SMRs) are accelerating, but these technologies are still several years away from becoming operational.

- Other electricity generation options are cheaper and faster to build. While nuclear is reliable, other forms of energy—like natural gas, wind, and solar—can be deployed more quickly and at a lower cost

*As a former stock analyst covering utility companies, I vividly recall following the hype around Southern Company’s groundbreaking on 2 new units to its existing nuclear plant. This was 2009. The units came online in…2023 and 2024, at a cost of $34B, over twice initially budgeted.

Though the power demands of A.I. have reignited interest in nuclear energy, it’s likely too early to declare this a full-blown U.S. nuclear renaissance. However, the pairing of nuclear energy with A.I.’s growing electricity needs is certainly reshaping the narrative, and it will be interesting to watch how this evolves in the coming years.