This is gold’s moment! Move aside, Bitcoin – the original hedge is back on center stage. With trade tensions boiling over, geopolitical risks flaring, and economic uncertainty hanging thick, investors have been reaching for gold as a financial safety blanket. And it’s not empty sentiment—the price has jumped from around $2,000 an ounce to over $3,000 over the past year. It makes sense. When markets wobble and confidence in the economy or market slips, gold’s safe-haven appeal shines. Whether seen as a hedge against inflation, a diversifier from stocks and bonds, or a store of value in turbulent times, gold often finds itself in the spotlight during global uncertainty. Gold is currently shining, but should investors consider it a long-term investment in their strategic allocations?

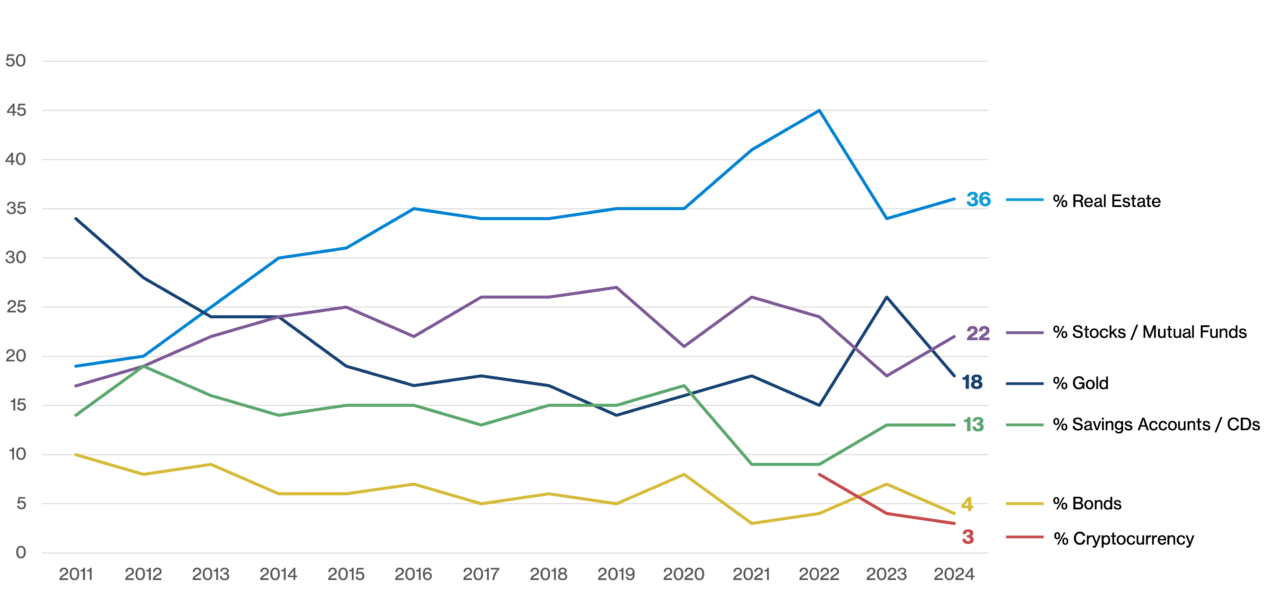

The public surely thinks so. Given a choice of the best long-term investment, gold has a special place in the hearts and minds of investors as it polls similar to stocks, the traditional bellwether of most investor allocations.

Gallup Poll: Which of the Following Do You Think Is the Best Long-Term Investment?

But before basing an allocation call on shining moments or public perception, it’s essential to take a step back and think about how gold behaves in both good times and bad. Strategic allocations aren’t just about navigating rough patches; they deliver balance and resilience through complete market cycles.

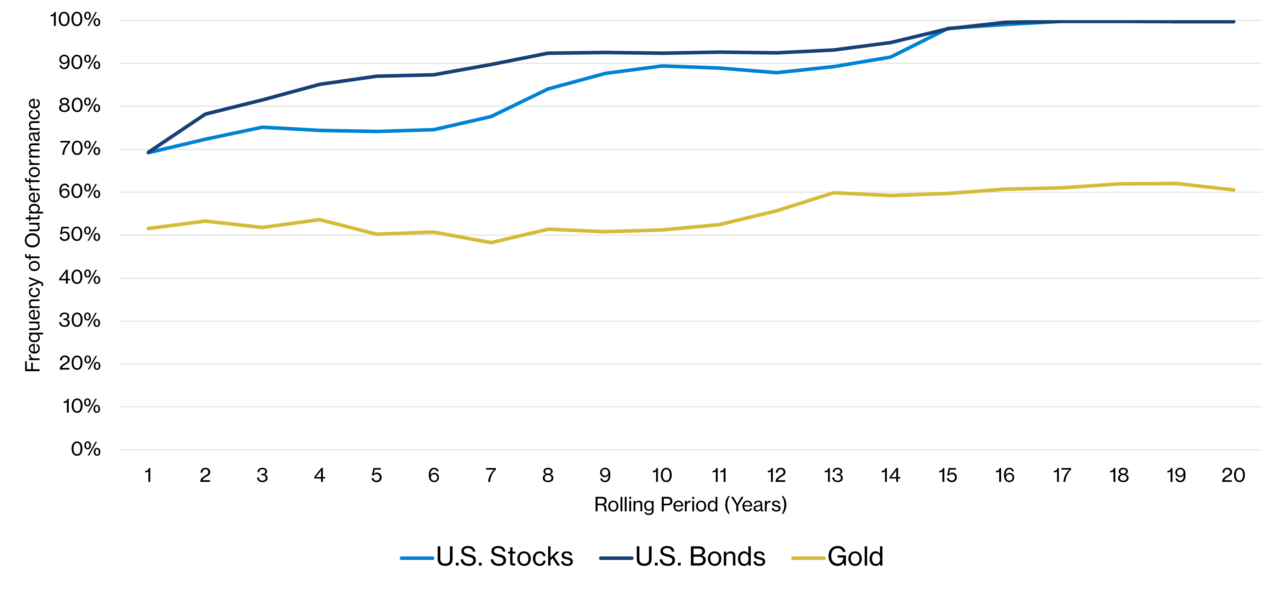

Gold’s reputation as an inflation hedge is a big part of its appeal. And there is truth to the fact that gold holds its value during unexpected inflation. But the story gets more nuanced if we zoom out over more extended periods. Over longer rolling time periods, gold hasn’t consistently outpaced inflation to the degree both U.S. stocks and bonds have. The chart below shows the frequency of stocks, bonds, and gold outperforming inflation over various durations.

Frequency (%) of Outperforming Inflation Over Rolling Periods

The chart’s lesson isn’t that gold is ineffective against inflation but that stocks and bonds have been more effective at growing real wealth over all periods than gold.

(I will concede that U.S. bonds generally had a tremendous 40-year run from 1981 to 2021, which bonds aren’t likely to repeat.)

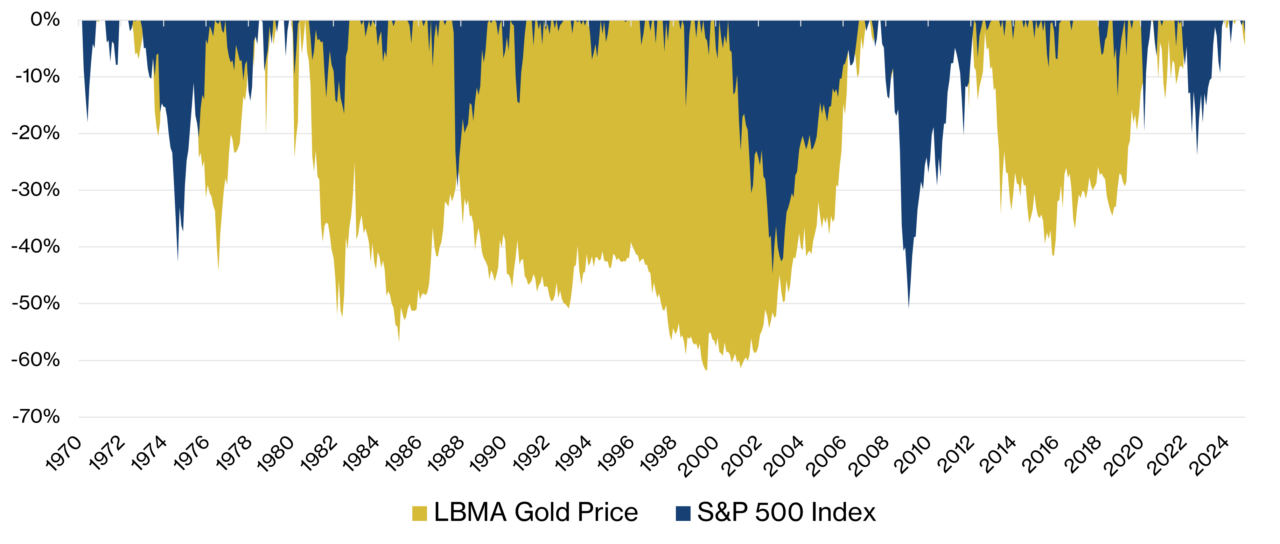

Gold also acts as a great diversifier to stocks and bonds as its performance doesn’t move in sync, especially during market stress. But it’s not a bulletproof diversifier, and its history of lagging against the long stretches of rising equity markets has made it feel more of a drag than a diversifier. Below is a chart showing the drawdowns from all-time highs of the S&P 500 Index and Gold over the last 50 years.

Historical Drawdowns (%)

The chart shows that gold has suffered steeper and more prolonged drawdowns than U.S. stocks, primarily during extended bull stock markets in the 1980s and post-Great Financial Crisis.

There’s no denying that genuine concerns fuel gold’s current glow. But it’s important not to simply port over this short-term narrative to the long-term strategy without better calibrating reasonable expectations. Gold isn’t the magical asset that performs well through all economic, geopolitical, or market regimes. That doesn’t mean it serves no purpose in a strategic portfolio, but allocations to gold should be modest.