Las Vegas is truly a magical place. Tourists flock from all over the world to experience the endless buffet of entertainment options. This weekend, Las Vegas will host its first Formula 1 race in 40 years, bringing the hugely popular sport to the streets that are home to multi-billion dollar casinos—a fitting event for a city that has embraced and rewarded risk-taking in many facets of life. Last year alone, the Las Vegas strip took in $8.3 billion (with a “B”!) in gambling revenue. That’s a lot of money changing hands! (If you’ve gambled, you know it’s mostly one-directional.)

Amid the glitz, glamour, and risk-seeking allure of Las Vegas are over 100,000 public employees who work in schools, hospitals, and various government agencies throughout Nevada. To protect these employees’ retirement benefits and financial security, the state-sponsored pension plan Nevada Public Employees’ Retirement System (Nevada PERS) has amassed over $58 billion in investment assets. It is no small task to manage and seek to grow this large sum of money for its members.

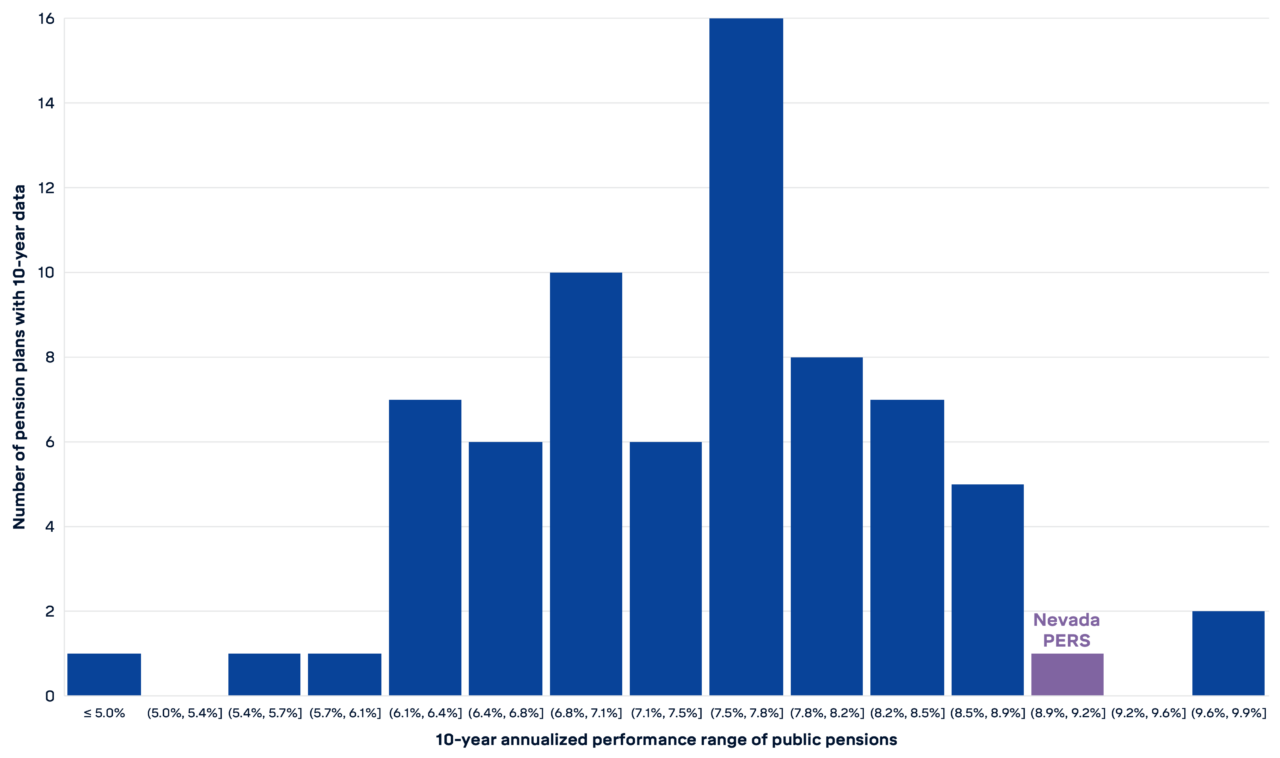

A recent tracking of the trailing 10-year performance for pension plans shows Nevada PERS near the top of its pension peers.

10-Year Annualized Returns for Pension Plans

Data as of Nov 2023

Nevada’s performance not only outperforms its well-heeled peers, but it’s also better than the standard diversified portfolio of stocks and bonds that regular investors might have. Within the same 10-year range, model portfolios with a 70/30 allocation returned 7.2% and a 90/10 allocation returned 8.6%.

What is their secret sauce for this enviable outperformance? Does the risk-seeking nature of Vegas permeate through to the investment allocation and manager selection of Nevada PERS? I picture aggressive allocations to venture capital, emerging markets, niche hedge funds, and exclusive manager opportunities. Maybe throw in a little Bitcoin and you’ve cracked the formula for Nevada’s success?

Nope. It’s actually quite the opposite and a stark contrast to the gambling nature of Sin City. Nevada PERS is notoriously basic in its investment approach. Their stocks and bonds, representing over 85% of the total allocation, are all in low-cost funds that mimic indexes. No fancy hedge funds, no glitzy stock strategies, no esoteric asset classes. Just a lone CIO in a non-descript public building in Carson City finding ways to keep busy.

It’s a radically simple investment approach that sticks out drastically among the heavily staffed, highly sophisticated peer group that tends to load up on active managers, private funds, and numerous asset classes. More importantly, it is a testament to embracing simplicity over unnecessary complexity regarding investment allocations. There’s nothing wrong with partying like Vegas while investing like Nevada (just please do so responsibly).