As the U.S. heads into another presidential election, concerns are growing about potential delays in results and the risk of unrest, especially given the heightened polarization in recent years. After the 2020 election, a significant portion of the electorate questioned the legitimacy of results, leading to the January 6 attack on the Capitol. The peaceful transfer of power—a hallmark of American democracy—now seems less assured than in previous years, and the possibility of election-related unrest is real.

For investors, this uncertainty adds a layer of complexity. How can you position your portfolio to withstand potential market volatility or economic disruption from the election? Here are some key strategies that can help you stay prepared and steady.

Build a Cash Reserve to Avoid Selling in a Down Market

A key step to safeguard your investments is to maintain a margin of safety in cash. We typically recommend that our clients hold at least one year of expected portfolio withdrawals in cash, in good times and bad. This cash cushion can prevent you from having to sell assets in a down market, helping you avoid locking in losses that may only be temporary.

Even if the market sees a sharp downturn (like the one in March 2020), a cash buffer ensures you can cover expenses without touching your investments, giving them time to recover. This cash reserve also acts as an emotional buffer, reducing the anxiety that can lead to impulsive, costly decisions. Given the strong stock market performance over the past two years, now may be an ideal time to take gains and shore up cash reserves.

Resist the Urge to Invest for “Armageddon”

Drastically shifting your portfolio to cash or safe-haven assets like Treasuries or gold can seem tempting, but history shows it’s not the best choice. During the Great Financial Crisis of 2008 and the COVID-19 market crash in 2020, those who made drastic portfolio changes out of fear missed out on the eventual recovery. If you sold during the COVID-19 crash in March 2020, for example, you missed one of the swiftest rebounds in history, with the S&P 500 climbing 70% by year’s end.

When fear takes over, it’s easy to think about preparing for a doomsday scenario— loading up on precious metals, defensive stocks, or cash-only assets. However, this approach can backfire over the long term, as it sacrifices potential growth and sidelines you from the market’s natural tendency to recover.

Markets are resilient. History shows that after severe downturns—the 1987 crash, 9/11, the Dot-com bust, the Great Financial Crisis, and COVID-19—they bounce back. Instead of overhauling your portfolio for the worst case, focus on your long-term strategy and ensure your investments are diversified for both good times and bad.

Stay Diversified

Diversification is a timeless investment principle for a reason. Holding a mix of asset classes—stocks, bonds, real estate, and perhaps even international investments— spreads your risk. If one part of your portfolio takes a hit, other areas may serve as stabilizers. For instance, bonds or defensive stocks may perform better during turbulent periods, helping offset losses in equities.

Election years often see heightened volatility in U.S. equities, so diversifying with international stocks and bonds can provide protection. While markets are interconnected, different regions often experience political and economic shifts on separate cycles, meaning foreign assets may not react as sharply to U.S. election outcomes.

Use Market Volatility to Your Advantage

British banker Baron Rothschild famously said that the best time to invest is when there is “blood in the streets.” What he meant is that often the best time to invest is when everyone else is selling. His advice is also reminiscent of Warren Buffett’s advice “to be fearful when others are greedy and to be greedy only when others are fearful.”

Periods of uncertainty and market fluctuations can be unsettling, but they can also present buying opportunities for investors with a steady hand. If you have available capital, market dips can be a good time to add to positions in high-quality stocks at a discount. If the election causes the market to decline, consider adding to your investment portfolio while others are panicking.

Focus on Fundamentals, Not Headlines

It’s easy to get swept up in the constant news cycle during an election, especially if there are delayed results or contentious issues. But reacting to every headline can lead to impulsive decisions that might harm your long-term financial health. Remember that stock market fundamentals—like company earnings, economic growth, and interest rates—are the main drivers of investment returns, not the daily news cycle.

Seasoned investors know to focus on the long-term picture, not short-term noise. Pay attention to the strength of your investments and the economy’s underlying health rather than trying to time every twist in election-related news. Historically, markets tend to refocus on fundamentals once the election is resolved, so a long-term perspective is critical.

Manage Your Emotions and Stick to Your Plan

It’s natural to feel uneasy during times of political and economic uncertainty, but letting emotions drive your investment decisions rarely pays off. One of the best things you can do is review your investment plan and ensure it aligns with your goals and risk tolerance. A well-defined strategy can help you face uncertain times with confidence, knowing your portfolio is designed for both growth and resilience.

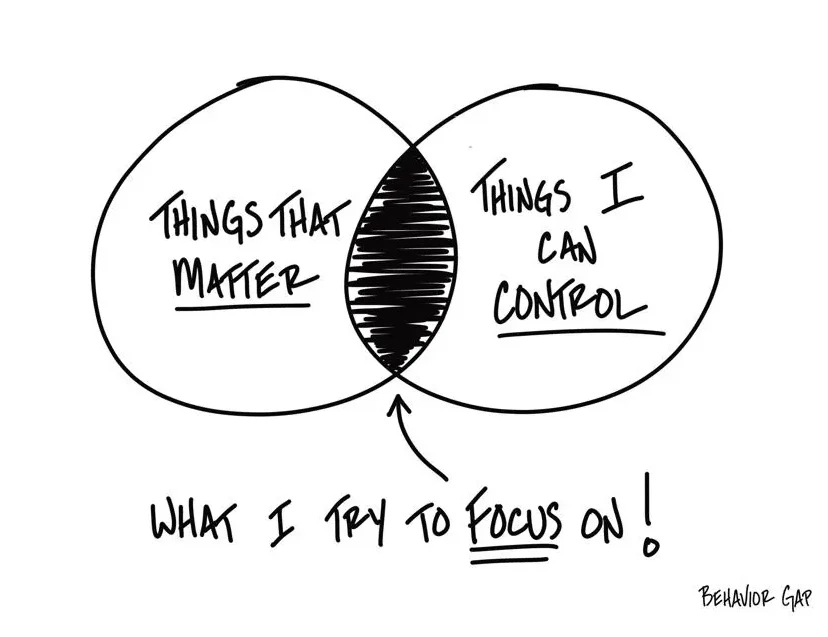

Take a look at the sketch below from Carl Richards at Behavior Gap—it’s an excellent reminder to focus on what you can control. While the election is important, beyond casting your vote, the outcome is ultimately out of your hands.

In Summary: Prepare, Don’t Panic

The upcoming election could bring more uncertainty and volatility to the markets, and worrying about delayed results or potential unrest is understandable. But these concerns don’t need to derail your investment strategy. By maintaining cash reserves, sticking with a diversified portfolio, avoiding extreme reactions, and focusing on the long term, you can protect your wealth and position yourself for future growth.

The key takeaway: prepare, but don’t panic. Remember, the goal is not to eliminate uncertainty—it’s to navigate it with a steady hand.