Did you hear that the price of Bitcoin eclipsed $100,000, which is over a 100% return year-to-date? Bitcoin’s eye-popping performance (along with that of most other cryptocurrencies) gives crypto enthusiasts extra reason to celebrate the upcoming holidays.

Prior jumps in crypto values have been attributed to cycles of hype and FOMO and have been followed by huge declines. However, this latest surge comes on the backs of an entirely new support structure that hasn’t been present in past episodes:

- Today, the regulatory environment for cryptocurrencies is becoming increasingly supportive, with clearer frameworks emerging from major financial jurisdictions. The sphere of influence surrounding the incoming administration in Washington includes several prominent proponents of blockchain technology and cryptocurrencies, signaling potential for favorable policy advancements.

- Furthermore, Bitcoin is now a key component of institutional financial products. Leading asset managers offer bitcoin-focused exchange-traded funds (ETFs) and trusts (with other top cryptocurrencies on the way), providing investors with new ways to gain exposure to this digital asset class through regulated channels.*

These developments have propelled bitcoin further into the mainstream, prompting a question: Should an investor consider an allocation to Bitcoin for their portfolio?

I raise the question of whether allocating to Bitcoin makes sense rather than the thousands of other cryptocurrencies and tokens that flood the market because Bitcoin is different. Many other cryptocurrencies are speculative projects or memes with little to no intrinsic value (take for instance, “Fartcoin”, which has a market value of almost $1B…so, ok). Bitcoin, by contrast, has established itself as the first and most recognized cryptocurrency, with a robust track record, a capped supply of 21 million coins, and growing adoption as a store of value. Its longevity and established network security tend to set it apart from the often fleeting fads in the broader crypto space.

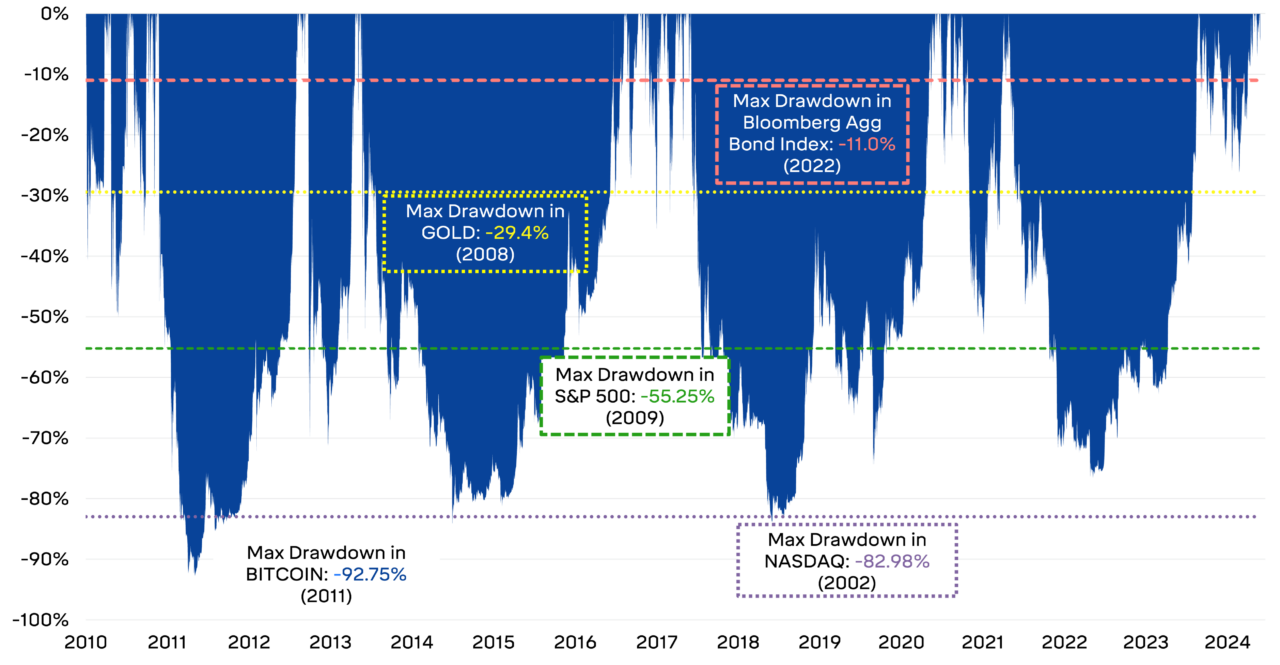

However, bitcoin’s increasing acceptance by institutions and its recognition as a mainstream asset do not negate its inherent risks. Bitcoin remains a highly volatile investment, prone to significant price swings that can test even the most patient investors. Its value has seen dramatic peaks followed by severe drawdowns. The chart below shows the historical price drawdowns for bitcoin going back to its inception. For comparison purposes, the maximum drawdown seen for stocks (S&P 500 + NASDAQ), bonds (Bloomberg Aggregate index), and Gold (Gold ETF) are overlayed.

Bitcoin price drawdown history

There were four instances where bitcoin saw at least 75% of its value decline! The frequency and depth of bitcoin’s performance declines compared to traditional portfolio investments like stocks and bonds is an uncomfortable reality that often gets overlooked in periods of enthusiasm and skyrocketing prices, as we see today.

So, should investors carve out a space in their allocation for Bitcoin? Probably not. There isn’t enough of a case for Bitcoin to occupy a material part of a portfolio. While regulatory clarity and institutional adoption have helped reduce some uncertainties, Bitcoin’s price movements are still influenced by speculation, macroeconomic factors, and market sentiment. It’s also plausible that the support among regulatory, political, and financial participants could change. That being said, having an amount of Bitcoin may be additive and fun. Investors embracing those aspects should size any allocation amount to limit the impact of its volatility on the broader portfolio and acknowledge the psychological and financial challenges of holding an asset that can fluctuate so dramatically. Enjoy the price milestones and buckle up!

*Interesting note: the largest holder of bitcoin is now U.S. ETFs with 1.16M, recently surpassing bitcoin’s founder Satoshi (estimated at up to 1.1M BTC)