Leverage is the use of borrowed funds (debt) to amplify investment returns and has a storied history in the world of finance and investing. Hedge funds and private equity use leverage to enhance returns. Given the success those professional investors have using leverage, should everyday investors also consider juicing their returns with debt?

Leverage is utilized in one of two ways. First, by borrowing against your existing assets and using those proceeds to invest in stocks or, second, investing in financial products that use leverage. While both strategies can reap the benefits, the latter option of buying a leveraged product is more straightforward and is the topic of this article.

How Leveraged ETFs Work

Investing in the S&P 500 index is easy because there are numerous ETFs that provide that exposure. But what if you want to magnify the returns of the S&P 500 using leverage? You are in luck! Exchange-traded funds (ETFs) exist with leverage options of 2x, 3x, and yes, even 4x (!) the exposure to the S&P. A leveraged ETF uses debt or financial derivatives to amplify the returns of its benchmark index. For example, a 3x (three times) leveraged ETF seeks to deliver triple the daily performance of the index it tracks. If the S&P 500 is up 1% on the day, the 3x fund will be up 3%.

Conversely, if you were bearish and wanted to attempt to profit from the market going down, you could invest in inverse ETFs using the same leveraged concept. There are 2x and 3x (but no 4x… yet?) inverse S&P 500 ETFs that seek to achieve a return that is a multiple of the inverse of the underlying index’s daily performance. If the market goes down 1%, the 3x inverse ETF makes +3% and vice versa. Intuitively, this all makes sense.

Given that the S&P 500 has earned about 10% annually over the past 50 years, it would seem to be a sound investment strategy to buy a leveraged ETF to earn double, triple, or quadruple that 10% annual return. But can it really be that simple? Let’s test that intuition.

Leveraged ETF Returns Aren’t What You’d Expect

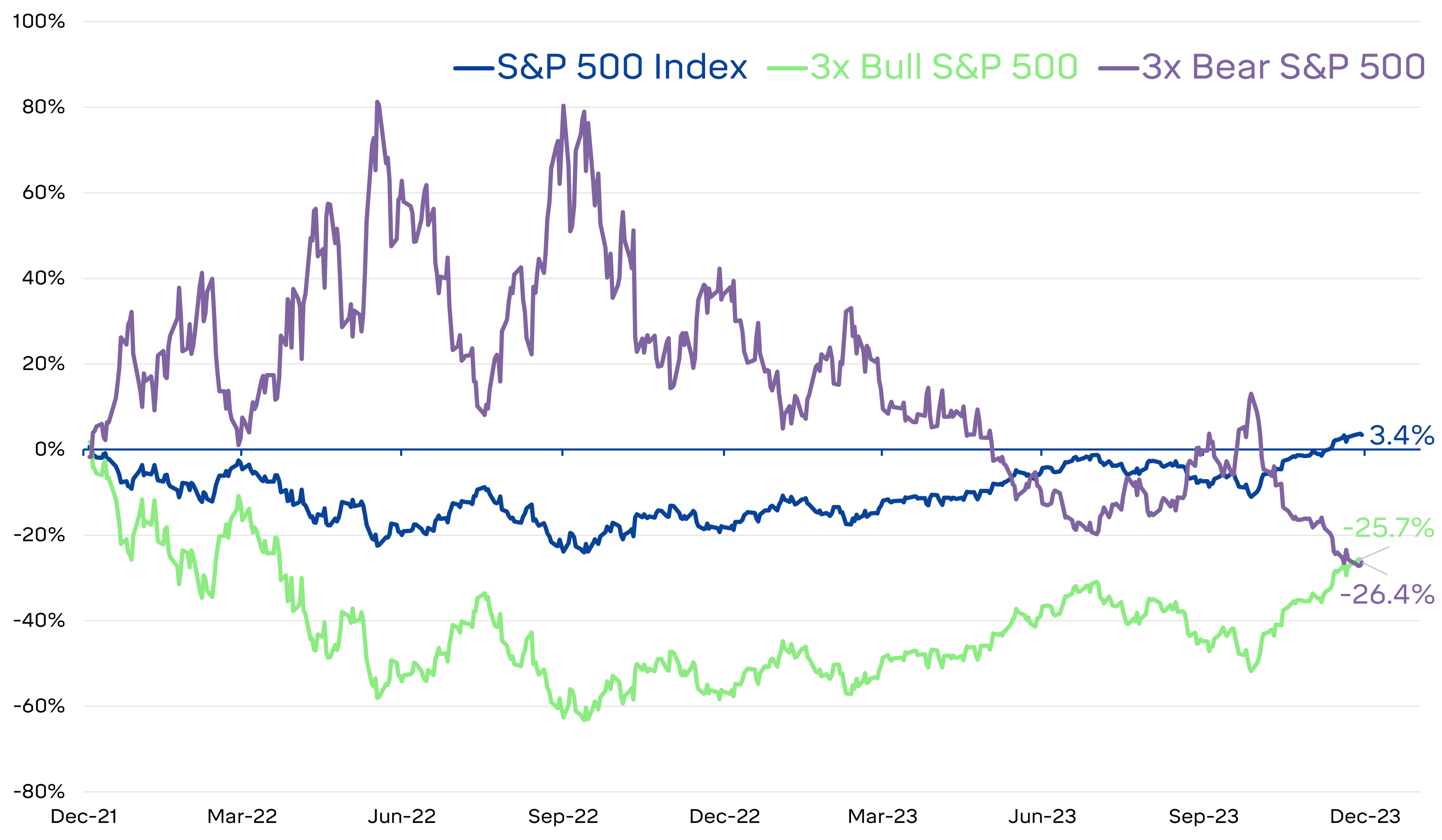

Over the past two years, investing in the S&P 500 Index has been a wild ride. 2022 saw inflation fears, rising rates, and concerns of an imminent recession. The market dropped 18% that year before rebounding 26% in 2023 on the back of economic resilience and big tech enthusiasm. Over that two-year window, the S&P 500 achieved a 3.4% total return. One would think that over that period, a 3x leveraged S&P 500 ETF return would be 10.2% (or 3.4% times 3), and the 3x inverse leveraged S&P 500 ETF would return -10.2% (3.4% times 3). But one would be wrong.

The chart below shows the performance of the S&P 500 compared to the 3x Bull and 3x Bear (i.e., inverse) S&P 500 ETFs. It turns out that both the 3x bull and 3x bear ETFs had negative performance at the end of the two years.

Performance for the S&P 500 Index, 3x Bull S&P 500 ETF, 3x Bear S&P 500 ETF

2021-2023

What gives?

Simply put, leveraged and inverse ETFs offer a multiplier on the daily returns of their underlying index, then wipe the slate clean at the end of each trading day. Multiplying daily vs. total returns seems like a subtle difference, but it leads to drastically different math.

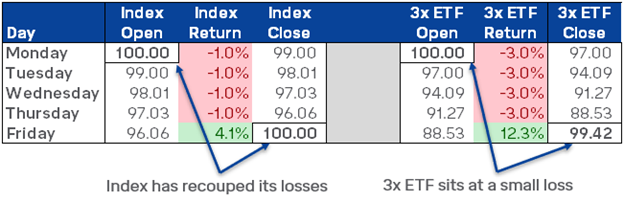

This is best demonstrated with an example:

Assume the underlying index loses 1% each day for the next four trading days, then gains 4.1% on the fifth day, which is the return that would exactly recover the four days of losses.

[Remember that when an investment experiences a negative return, it will require a higher rate of return to bring that investment back to its starting point. For example, if you start with $100 and experience a -25% return and land at $75 asset value, you must earn 33% to return the portfolio value to $100.]

Now, for the 3x enhanced index over this same period, the results will be slightly different because of this decay:

This erosion of returns occurs with each daily reset, and when a fund is leveraged, that erosion is magnified. Larger losses need even larger gains to get back to even. The 3x ETF needed a 13% gain on Friday to break even but only got 12.3%, leaving it at a loss. If you compound these differences over time, the deviation gets wider.

This means that leveraged ETFs are not suitable buy-and-hold products. This conclusion is supported by a research paper from the SEC’s Division of Economic and Risk Analysis that analyzed simulations of a buy-and-hold approach to a leveraged S&P 500 ETF over various time periods and leverage multiples and found the likelihood of experiencing losses increases under both conditions.

Successful investing incorporates diversification, avoiding market timing, and adhering to a long-term view. With leveraged ETFs, the best outcomes require the opposite: to try to time the markets and employ very short holding periods. That’s a trading strategy, not an investing one.