Happy New Year, investors! With the holidays behind us and 2024’s returns officially in the books, we’re now greeted by the annual wave of market and economic forecasts for the year ahead. There is no shortage of opinion on what the stock market will do, how fast the economy will grow, or what corner of the world will produce the best returns for 2025. But before we blindly follow these convincing predictions, it’s worth a quick look back on how forecasters historically fared on the most coveted outlook of all – the S&P 500 price targets.

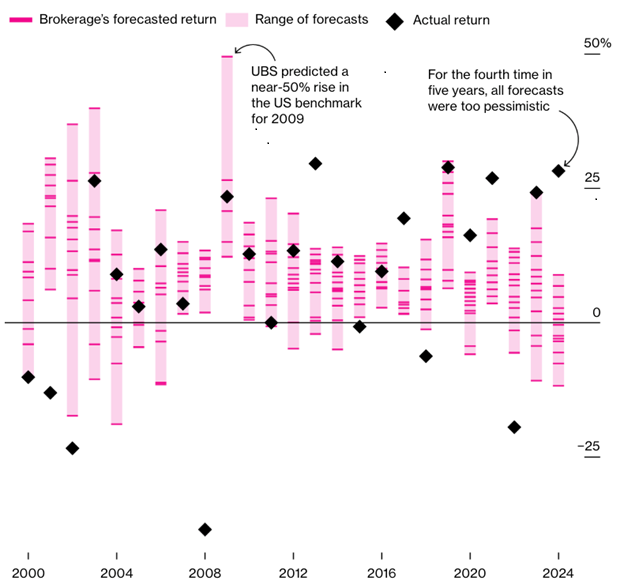

Below is a fantastic chart from Bloomberg that looks back at the range of forecasted returns made by Wall Street and where the actual market return ended up.

Predicted and Actual Returns for the S&P 500 Index

These results don’t instill a lot of confidence for investors, particularly given the actual returns fell outside the range of predictions in 7 of the last 8 years. It appears that accurately forecasting may be hard to do, but is it completely useless? Or can investors find any benefit from them?

To help answer that question, let’s unpack a few critical truths about market forecasts:

- They sound intelligent and well-reasoned – Market forecasts are crafted by highly credentialed analysts and seasoned strategists with years of experience navigating complex financial landscapes. These professionals use a combination of historical data, economic indicators, and sophisticated modeling techniques to support their predictions. Their insights are often articulated with precision and confidence, lending an air of authority that resonates with audiences. However, despite the rigor behind the forecasts…

- They are always inaccurate, across stocks, bonds, rates, GDP, etc. – It’s not just about S&P 500 price targets, but the historical accuracy rate for predicting the level or path of interest rates, unemployment, inflation, and GDP growth is persistently low, more so over longer forecasted horizons. Which makes sense as forecasters tend to extrapolate current trends and known risks, while being unable to foresee or factor in the unknowns that make markets inherently unpredictable (think COVID-19).

- There is no magic bullet – No data point has 100% predictive success. As much as we’d love to hang our hat on metrics like P/E ratios, earnings growth, yields, inflation rates, etc., these metrics don’t lead directly to forecasted outcomes. Consider them useful tools that are more insightful than effective. And even if a perfect predictive metric existed, it would quickly lose its edge as markets adjusted to reflect that knowledge.

- It’s marketing – Forecasts are used to support firm’s views on the markets and guide investment positioning with the help of their products and services (how convenient!). There is a vast newsletter business conveying “top picks” or often-alarming scenarios in efforts to capture clicks, advertisers, and customers. It’s less about them being accurate than being engaging. Which makes complete sense, when you consider…

- We love forecasts – Despite the apparent flaws in them, investors gravitate towards those who promise certainty. Strategies can confidently churn out forecast after forecast knowing that investors will dismiss the lack of accuracy or hit rate while finding comfort in the sense of certainty.

What, if anything, should investors take away from forecasts? It’s clear that they are no crystal ball. But that doesn’t mean they’re worthless. The key is to treat forecasts as a source of information, not instruction. Behind every forecast is a wealth of research, data, and analysis that can deepen your understanding of the market environment. Look beyond the predictions themselves and focus on the trends, risks, and themes they highlight. Use this information to stress-test your portfolio, evaluate potential scenarios, and ensure your investment strategy is robust across a range of outcomes. Most importantly, maintain a healthy skepticism: recognize the limitations of forecasts, avoid overreacting to specific predictions, and stay committed to a diversified, long-term investment approach. By using forecasts as a tool for preparation rather than a guide to decision-making, you can benefit from their insights without falling into the trap of misplaced certainty.