Holding cash or cash-like investments such as short-term Treasuries and money market funds has been rewarding for the past couple of years. They earn actual interest in the range of 4-5%! (a seemingly foreign concept during 2009-2022). Not bad for practically risk-free investments. The yields on cash and near-cash investments are similar to the federal funds rate, a reference rate set by the Federal Reserve (the “Fed”). Earlier this week, the Fed finally lowered that reference rate by 50bps, or 0.5%. Does this signal lower interest rates for cash-like investments going forward? And should investors re-think how they allocate their cash?

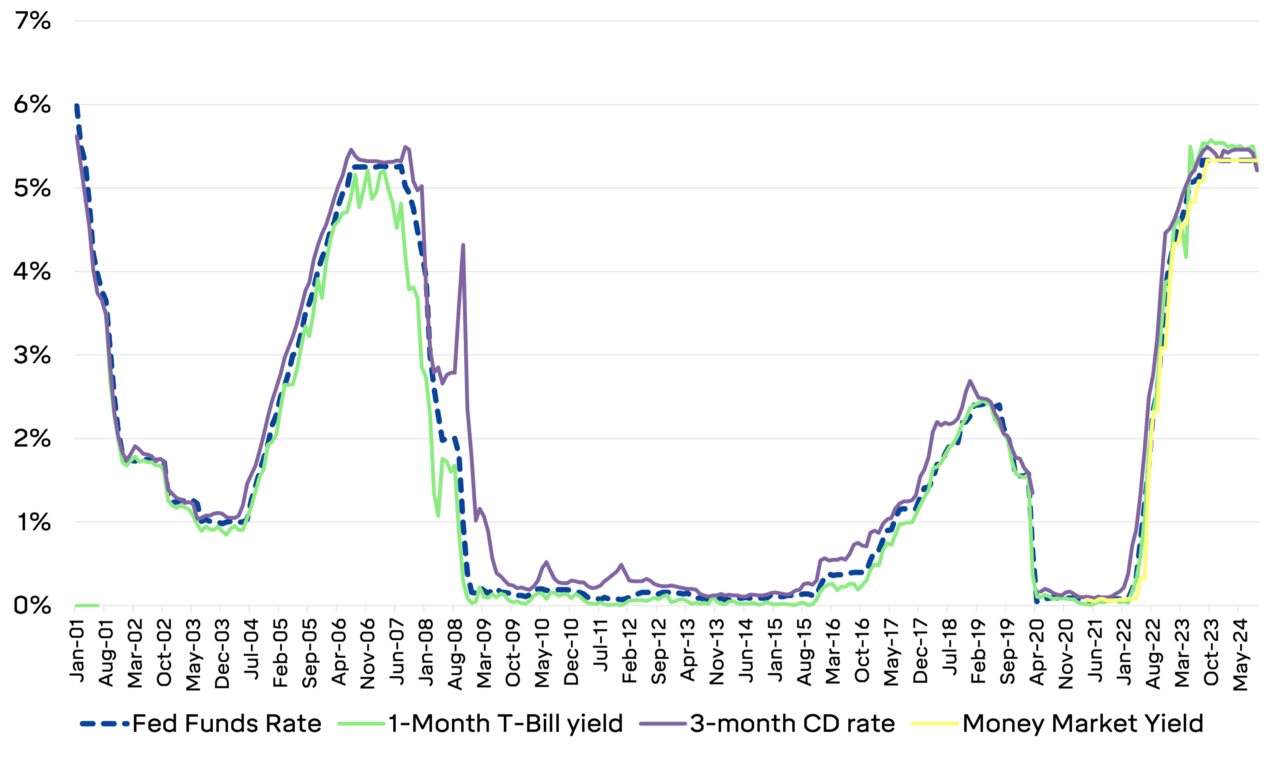

Scanning the financial headlines or reading through market commentaries over the past few weeks, you’d think that the Fed controls every interest rate. While the Fed’s interest rate decisions have wide-reaching influence, it’s essential to understand their impact. The federal funds rate is the interest rate at which banks lend reserves to each other overnight . It strongly influences other short-term interest rates in the market, particularly those that affect cash-equivalent investments. The chart below shows that cash-equivalent yields tend to move near lock-step with the federal funds rate.

Federal Funds Rate vs Short-Term Cash Investments

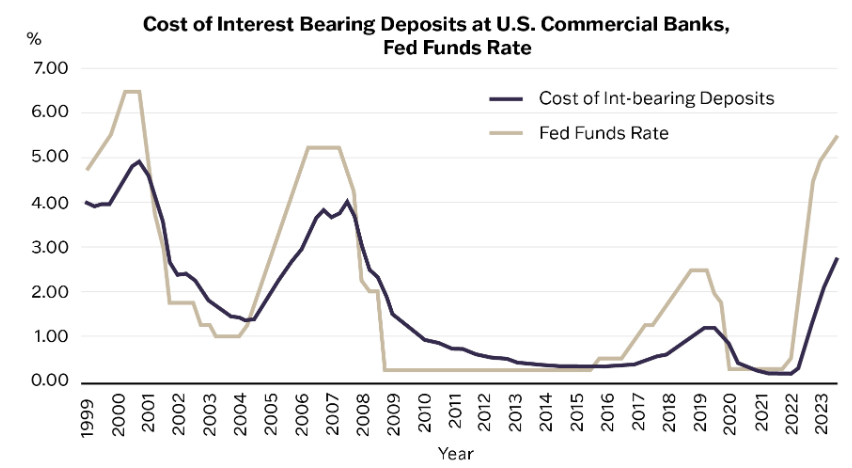

What about those generous savings rates offered by your friendly bank? Is that a place to find refuge and migrate to during a rate-cutting environment? While changes in the federal funds rate impact money market funds and other short-term investments rather quickly, their effect on traditional bank savings rates tends to lag, as shown in the chart below. Banks may not immediately reduce their savings account rates following a federal funds rate cut, especially if they are competing for deposits. However, over time, savings rates generally follow the direction of the federal funds rate. This means that although the decline in savings rates may not be instant, savers should expect lower yields if the rate cut persists.

Investors should anticipate that the returns on their cash and money market funds will likely decrease because of the recent rate cut. However, this doesn’t mean it’s time to abandon these investments in favor of higher-risk options like stocks. Cash-like investments still serve an essential role in a diversified portfolio by providing liquidity and preserving capital. While their yields may become less attractive, their relative safety and stability can be crucial, especially during periods of market uncertainty. Investors should remain cautious and avoid chasing higher returns by taking on more risk than they are comfortable with.