Our firm won two new clients near the end of 2007 who both had received a large influx of cash from selling their business. Let’s call one client Smith and the other Jones. We gave them both the same advice: invest the money over the next 12 months at predetermined intervals. Smith followed this advice through the precipitous market decline of 2008. It was very tough going because at each investment tranche, the economy and markets were crazy volatile, and fear was gripping us all. Jones, on the other hand, invested one tranche at the beginning of 2008 and then didn’t invest the rest until 2011 when it appeared that the economy was out of the woods. Who fared better financially? Smith. Even though she invested just before and during the worst market decline since the Great Depression, her portfolio rebounded nicely. Jones’s portfolio avoided much of the drawdown in 2008 and early 2009 but missed the strong returns in 2009 and 2010 after the market bottomed.

It may be surprising that Smith, who invested just before and during a bear market, did better than Jones, who waited until the coast was clear. But history has shown that investing in advance of a bear market (or remaining invested) is not as bad as you might think and sometimes turns out great. Unless you call market tops and bottoms correctly, which beyond being lucky is nearly impossible, you are usually better off investing a cash pile in a diversified and disciplined manner than trying to time the markets.

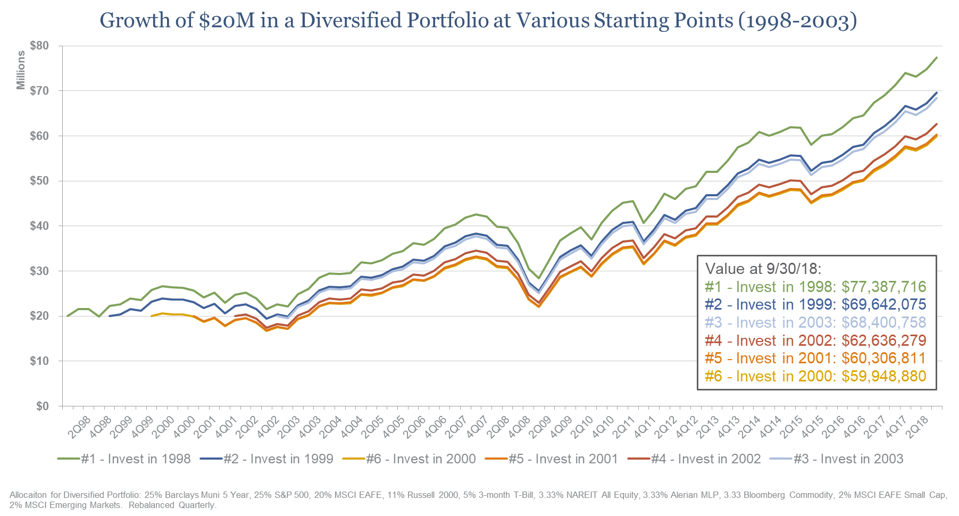

This may seem counterintuitive but consider the following charts. Each assumes that an investor starts with $20 million of cash and invests in a diversified portfolio (about 70%/30% stocks/bonds), which is rebalanced quarterly. The $20 million of cash is invested in a lump sum on January 1 of each of the indicated years.

The first chart shows that investing on January 1, 1998 (the green line) – about two and a quarter years before the top of the market during the dot-com bubble – resulted in the best long-term returns. The second-best result came from investing on January 1, 1999 (dark blue line), only one and a quarter years before the market top! Under every scenario, the $20 million more than doubled by September 30, 2018. Waiting until the stock market had about bottomed in January 2003 came in third.

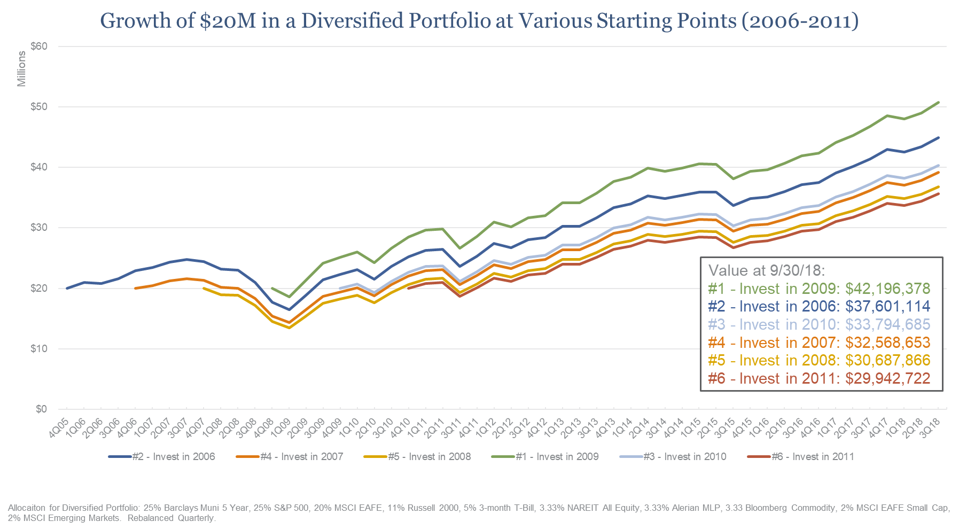

The following chart illustrates the same exercise over a shorter period around the financial crisis of 2008.

If you invested money in the market on January 1, 2009, three months before the market bottom, you did best. But, investing on January 1, 2006, less than two years from the market top, gave the second-best outcome. Waiting for an “all-clear signal” and delaying until 2011 gave the worst outcome (as our client Jones experienced).

A 2012 study from JP Morgan* buttresses this point by simulating an investor “waiting for a clear turn in the business cycle before adopting normal investment positions.” The study examined two different strategies:

One: Stay fully invested through good times and bad; or

Two: Only invest when the “coast is clear.”

The report defines the coast being clear as when the stock market’s valuation is reasonable, unemployment is low or falling, the economy is expanding, and inflation is below 4% or declining. If the economy meets all these criteria, then the coast-is-clear portfolio is invested in the stock market; if not, the portfolio is moved to cash.

How did the two portfolios do? While the coast-is-clear portfolio was less volatile, it sacrificed a lot of return. From 1948 – 2011 the “always-invested” portfolio beat the coast-is-clear portfolio by nearly three times and from 1980 to 2011 by more than twice.

The lesson of the two charts and the J.P. Morgan study is that investing in advance of a bear market likely will turn out fine so long as you stick to your investment strategy and periodically rebalance your portfolio accordingly. Also, the simulations above do not include portfolio withdrawals; it’s a good idea to have a margin of safety in cash if you might need to spend from your portfolio.

There is no bell that rings to signal the best time to invest, and waiting until the coast is clear is a poor investment strategy.