The private equity industry has gotten really big. By one estimate there are close to $13 trillion (with a T!) of private assets under management across the world, ascending from a level of $2 trillion just 10 years ago. To put that in relative context, the S&P 500 index represents about $37 trillion of market capitalization.

As the private markets have grown, so have the fund sizes of private equity and debt managers looking to add or extract value from these private businesses. It is common to see PE funds in the market seeking to raise $15B, $20B, or even $30B for a specific vintage year. These are usually raised by the established and renowned investment firms like Blackstone, KKR, Apollo, and Carlyle.

But are bigger funds any better when it comes to fund performance vs. their peer group?

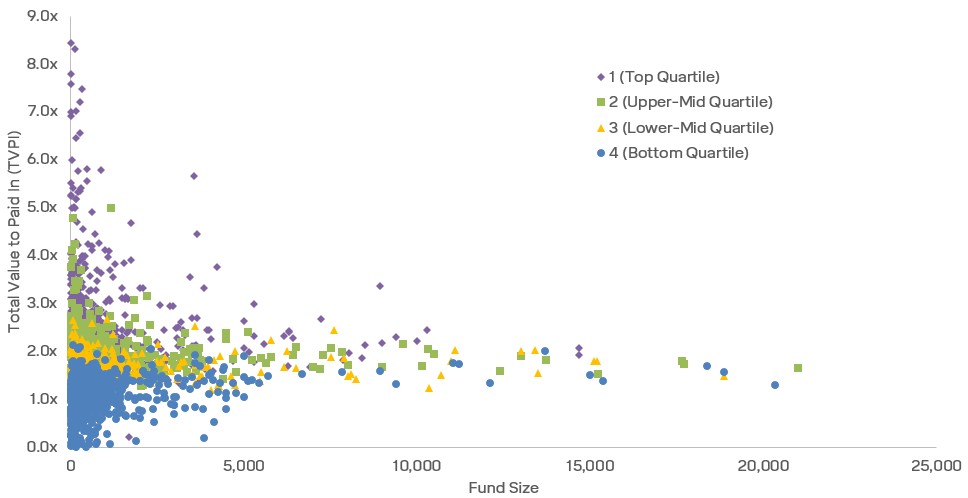

I went into our Pitchbook database and pulled private equity fund returns for vintage years 2003-2017. The individual funds are plotted on the X-axis according to the size and further analyzed on the Y-axis as to how those funds performed in absolute sense and per quartile rankings relative to their peer group.

Private Equity Industry Performance by Fund (Vintage Years 2003–2017) vs. Fund Size

As an investor, you wanted to be in the purple diamonds (top quartile) and avoid the blue dots (bottom quartile). What becomes clear is that most top-quartile PE funds tended to be smaller sized funds. BUT, smaller funds also saw a lot of bottom quartile performance. (Welcome to risk, everyone!) The larger funds have a less variable performance history and tend to fall somewhere in the middle relative to their peers. <golf clap>

Investors get pitched the established, name-brand, gargantuan PE funds all the time. They have huge distribution arms and appeal to many institutional investors. Investment committees who are averse to getting fired will happily give these ‘safe bets’ a look.

Why do PE funds get so big anyway? Sure, the opportunity set of private investing has grown, but these big shops also have a lot of mouths to feed (with delicious management fees!). Incentives for managers of large funds are skewed toward accumulating assets instead of maximizing returns.

Our approach to private investing has always been cognizant of the size of the fund being offered. There are cases where ‘bigger is safer’ is an acceptable criterion for investing. But that’s also like trick-or-treating and getting handed a pencil. If you are going to lock up your money for a decade, more efforts should be made to seek the best and not the biggest. Unless you like getting pencils.