Private credit has become a hot topic in sophisticated investment circles, and it’s easy to see why. Private credit broadly describes privately traded debt instruments provided by non-banking entities, such as asset managers. These investments range from standard corporate debt, known as Direct Lending, to more complex debt used in bankruptcies and restructurings, often called Distressed Debt or Special Situations. Today, yields on these strategies are advertised between 13% and 18%. However, before chasing that return, it’s crucial to consider the significant tax implications associated with private credit investments.

The Tax Impact

When asset managers promote 13-18% returns on private debt investments, it certainly grabs attention. But for taxable investors (like individuals), what really matters are after-tax returns. That’s why understanding the tax drag on these investments is essential.

Private credit encompasses a variety of loan types, some of which include an equity component that can alter the tax liability. However, the most popular type—direct lending—generally produces a high current yield without equity participation. Unfortunately, the income from direct lending is taxed at ordinary income rates, which are typically higher than the rates on dividends and long-term capital gains.

This high tax rate, combined with the substantial fees often associated with private credit, significantly reduces investors’ actual return.

Fees and Their Impact

Another important factor to consider is the high fees associated with private, illiquid investments like private credit. Managers usually charge both an annual management fee and a performance fee, meaning the higher the return, the more fees they collect.

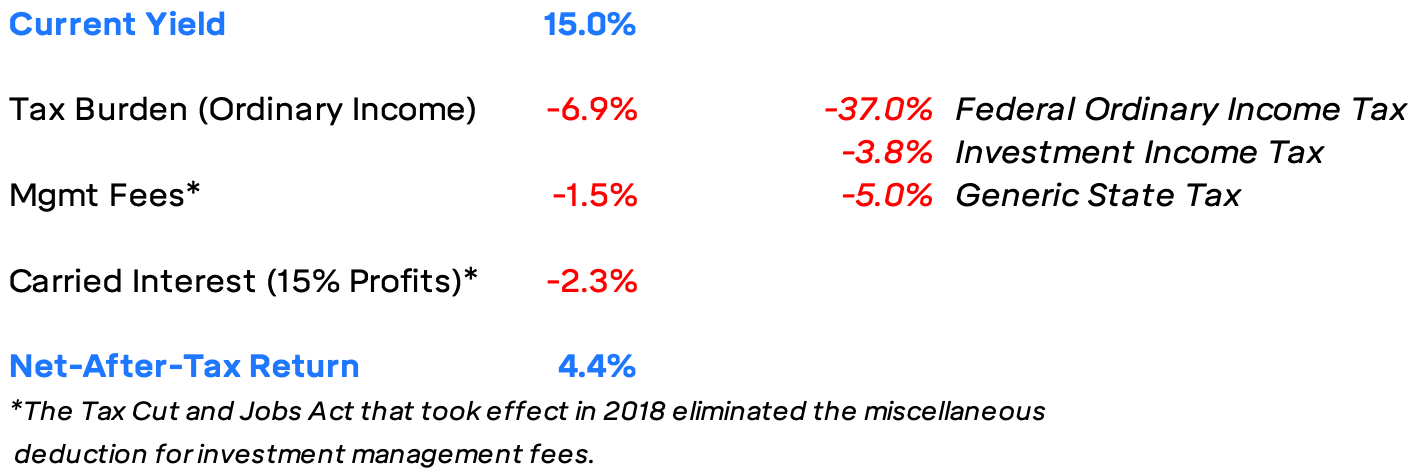

Below is a simplified example showing how a private credit fund yielding 15% might perform after accounting for taxes and fees:

What Do Taxes Do to Private Credit Returns?

As the example illustrates, a robust 15% return can shrink to a mere 4% once you factor in taxes and fees. For this reason, we often recommend that taxable clients steer clear of most private credit investments.

A Better Alternative

Instead, we suggest directing those funds into a Municipal High-Yield strategy. While it may also involve illiquidity and higher fees, the tax impact is removed, making it a more efficient option for taxable investors.