Comparing Private Foundations and Donor Advised Funds

Around the holidays, we hear a lot about Black Friday and Cyber Monday, but in this article I am not going to provide any shopping advice or relay any horror stories about getting in line at Best Buy at 5:00am. Rather I will focus on GivingTuesday and the various charitable vehicles families can use to fund their philanthropic priorities.

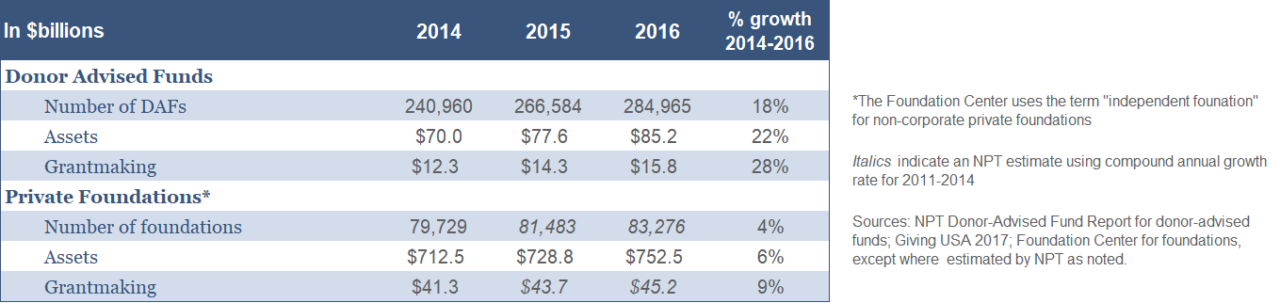

The vast majority of charitable giving in the U.S. is made directly by individuals to charitable organizations. According to the data, personal giving is over four times greater than giving that comes from private and corporate foundations.1 However, for families of great wealth, who prefer more structure around their philanthropy, the most common giving vehicles are private foundations and donor advised funds (“DAF” or “DAFs”). Currently DAFs out-number private foundations by 3 to 1 as shown on the chart below.2 Interestingly, the inverse is true about the amount of assets held in these charitable vehicles as total assets at private foundations are nearly ten times the amount in DAFs. Also payouts from DAFs as a percentage of total assets exceeded 20% in 2016 versus only 6% from private foundations.3

What is driving the explosive growth of DAFs versus private foundations? This article will explore the difference between the two vehicles in an effort to explain the trending preference of a DAF over a private foundation.

Donor Advised Fund Growth Compared with Private Foundation Growth

Establishing a Charitable Vehicle

Both private foundations and DAFs are charitable organizations exempt from income tax under Internal Revenue Code §501(c)(3); however, the processes to establish these types of organizations are dramatically different. A private foundation is a freestanding entity organized under state law, either as a corporation or a trust. Legal and tax counsel are needed to file organizational documents and a Form 1023 – Application for Recognition of Exemption with the Internal Revenue Service (“IRS”). Form 1023 and its accompanying schedules and worksheets can exceed thirty or more pages and, not surprisingly, the IRS turnaround to grant exempt status often takes, on average, six months. Thus, setting up a private foundation takes time and expense.

In contrast, creating a DAF is as simple as opening an account that happens to be maintained, operated and legally controlled by a sponsoring organization. Sponsoring organizations include community foundations, well known public charities and charitable funds associated with investment firms. There are usually no start-up costs to open a DAF account and the initial asset requirements are very low (some start as low as $100).

Control and Flexibility

A private foundation, similar to a regular taxable corporation or trust, is governed by directors and/or trustees. These parties are responsible for managing the foundation’s daily affairs, hiring a staff (if necessary), and approving grant requests. With a DAF account, technically, the initial creator or donor of the account can only advise the sponsoring organization as to which grants he/she would like to make from the account. However, for all practical purposes, the sponsoring organization almost always fulfills the grant-making wishes of the donor if the request meets grant-making guidelines (i.e. grants to 501(c)(3) charitable organizations).

There are also differences in the investment management of private foundations and DAFs. A private foundation’s directors/trustees have full control over investment policy, choosing investment managers, investment vehicles, and custodians. Depending on a DAF’s sponsor organization, there may be some investment management flexibility, but a donor is more likely to encounter restrictions in types of investments, or must agree to allow the sponsor organization exclusive management of the assets.

Private foundations provide the flexibility to make multi-year pledges to charitable organizations, which are prohibited by DAFs. Another difference between the two vehicles relates to long-term viability – a private foundation can be perpetual, giving the organizing family the ability to pass on a philanthropic legacy to future generations through the ability to serve as directors/trustees. Most DAFs only allow for appointment of successor advisors for one or two generations. If any funds remain in the account after that, then they revert to a general fund to be administered by the supporting organization.

Taxes, Reporting Requirements and On-Going Maintenance

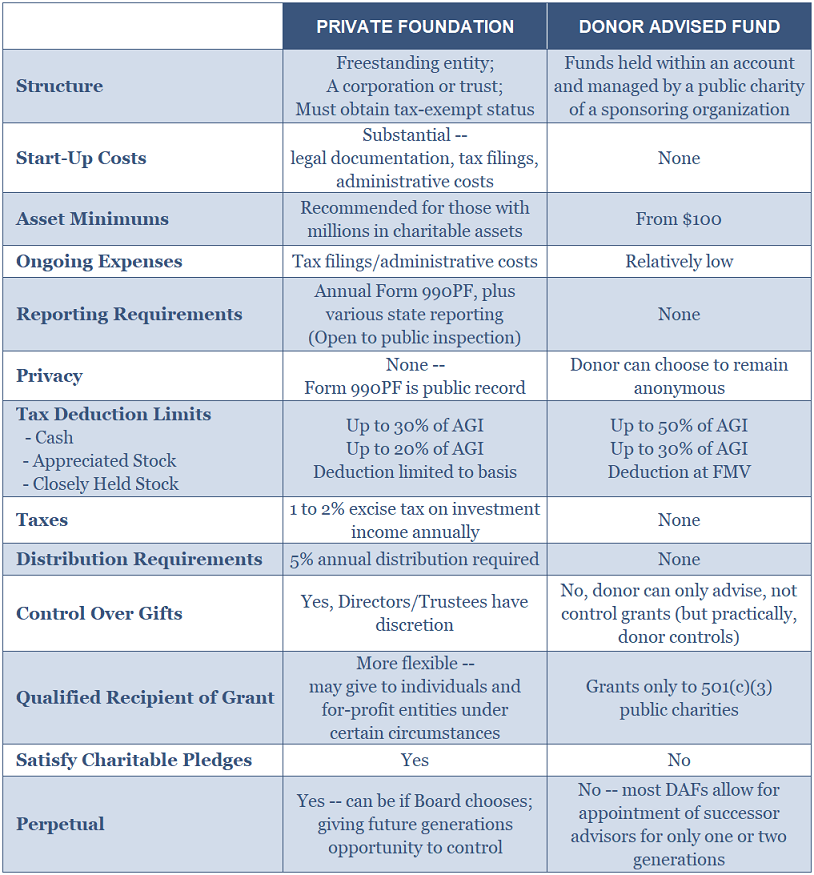

A donor’s ability to deduct donations made to private foundations and DAFs on their personal income tax return is subject to certain limitations based on the donor’s adjusted gross income (“AGI”). These limitations are different depending on type of donation made and whether made to a private foundation or DAF account. The deductibility of a cash donation to a DAF is limited to 50% of the donor’s AGI, whereas if the same cash donation is made to a private foundation, it is limited to 30% of the donor’s AGI. Similar reductions in the limitations apply to gifts of appreciated stock and closely held stock as shown on the comparison chart at the end of this article. These differences can be significant for generous donors with lower AGIs and create unnecessary charitable contribution carry forwards.

As stated above, both private foundations and DAFs are exempt from income taxes, but private foundations are subject to certain excise taxes and complex administrative rules as set forth by the Internal Revenue Code. The IRS requires that private foundations pay out at least 5% of the previous year’s average net assets for charitable purposes. The IRS also requires an annual Form 990-PF to be filed by a private foundation. This form captures information regarding a private foundation’s investment income, major donors, grants, assets and liabilities, and other activities for a calendar year. Once filed, this form is open to public inspection eliminating all chances of keeping the foundation’s affairs private. Many states also have separate reporting requirements for private foundations, which are likewise open to public inspection.

The types of excise taxes collected on the annual Form 990-PF include a 1 to 2% tax on investment income, and potentially onerous penalty excise taxes on activities or transactions entered into by a private foundation and/or directors/trustees not in furtherance of its charitable purpose. The rules surrounding prohibited transactions and investments are complex and potential traps for unwary directors/trustees without good legal and tax advice. Finally, a private foundation may also be subject to an income tax on any income earned from a trade or business. This usually occurs when a foundation has an ownership in a fund with underlying business interests. This “unrelated business taxable income” is taxed at regular corporate tax rates. Accurate recordkeeping and documentation is a must for private foundations because of these complex rules.

DAF accounts are not subject to any reporting or filing requirements, the excise taxes described above, or required annual minimum distribution amounts. Donors can also choose to remain anonymous.

Conclusion

The ease and efficiency with which DAFs can function for donors has no doubt caused their explosive growth in popularity. Most families choose a DAF as opposed to a private foundation due to costs, complexity, and lack of privacy associated with the latter. Yet, depending on a family’s philanthropic and multi-generational goals, a private foundation may still be the right answer. This is especially true for families wishing to retain tight control over the management, governance and grant-giving, as well as those seeking the perpetuity of a foundation. If you are considering establishing a charitable vehicle, please do not hesitate to reach out to me.

Comparison of Private Foundation to Donor Advised Fund

1 http://www.philanthropyroundtable.org/almanac/statistics

2 https://www.nptrust.org/daf-report/giving-vehicle-comparison.html

3 https://www.nptrust.org/daf-report/recent-growth.html