Venture capital investing (VC) has been the cool kid on the investing block since it emerged at the onset of the personal computer age. If you need a brief introduction: venture capitalists are investors who help finance start-up companies at their earliest stages and provide them with capital, technological expertise, or management experience. Across the world, entrepreneurs are formulating business ideas that may enhance or grow entire new industries, and VC investors get a front-row seat. Could you imagine hearing the pitch for Uber early on and deciding whether to give them money? (“Sounds like you are starting another taxi company,” I might have responded…) But Uber took venture capital money early on and became a multi-billion dollar company, enriching those VCs and their investors who took the risk. Many successful public companies we see today had their starts where mere ideas and business plans were supported by those willing to write checks when others wouldn’t.

Given the success stories we hear about in headlines, one would assume that investing alongside venture capitalists would be a lucrative investment. And you’d be right! Venture capital as an asset class has generally performed very well compared to other forms of equity investing. However, when you dig beneath the allure of venture investing, the distribution of these eye-popping investment returns isn’t remotely equal among all VC participants.

This brings us to the ‘Power Law’ and its relevance in venture capital returns. The power law is a principle that says a handful of investments typically drive the bulk of returns. Like the 80/20 rule, where 80% of the output comes from 20% of the input.

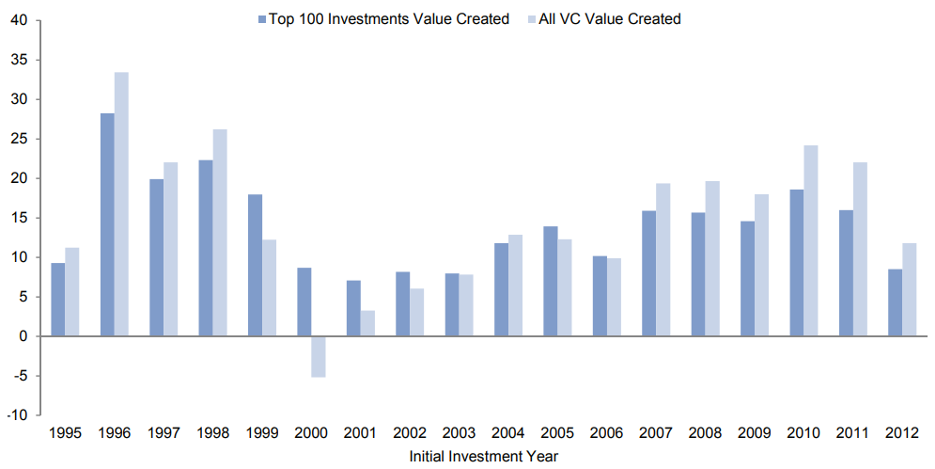

To better understand this power law dynamic, we can reflect on this fascinating research piece Cambridge Associates published in 2015 (found here). They analyzed almost 2,000 venture investments made across hundreds of VC funds over the prior 18 years and discovered the top 100 investments each year accounted for anywhere from 72% to over 100% of the total VC gains that year.

Venture Capital Value Creation: Top 100 Investments Compared to Total Asset Class

As of December 31, 2014 (USD, billions)

Finding those outliers seems crucial to capturing the bulk of venture capital returns for an average investor. Fortunately, there is a plethora of venture capital managers out there that can capture these outliers and provide investors handsome returns, right? (You may know where this is going.)

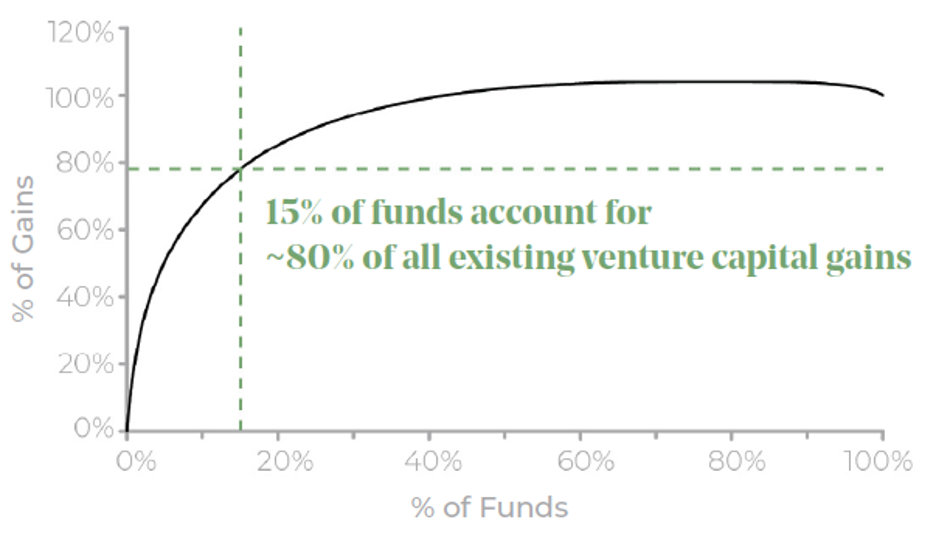

Unfortunately, the Power Law of Returns seems to be not just at the investment level, but also at the VC firm level. A recent research piece by Global Endowment Management used a VC database to determine that just a mere 15% of VC funds account for around 80% of all existing venture capital gains (using the periods 1990-2018).

Power Law Distribution in Venture Capital

Venture capital performance is built on layers of outliers, but that shouldn’t discourage those investors who embrace the risk and probabilities. It just requires a diligent selection process and appropriate expectations. Think of it as part of the ad-venture! And how do you invest with these top venture capital managers? That will be the topic of a future Sound Smart blog post. Stay tuned.