It was a December to remember in terms of stock market performance. After hitting new highs in late September, the broad S&P 500 Index performance fell throughout the last few months of 2018, most notably during the last month of the year. On 12/24, the S&P 500 closed at a level off 19.8% from its prior high – just 0.2% away* from market watchers being able to ring the “bear market” bell and churn out endless articles. Since late December, the broad market has seen a sharp recovery as it aims to reclaim the lost ground in performance.

*The consensus measure of a “bear market” is when a broad equity market falls at least 20% from a prior high.

The last several months have shown a heightened level of market volatility, and volatility is a concept that seems to be synonymous with risk. However, volatility is essentially just a measure of price swings of an investment in either direction – higher or lower. Volatility isn’t itself “bad” in the investing sense – especially when it works for you (e.g. stock is shooting up materially higher. Sweet!) – but when there is higher volatility, there needs to be a greater acceptance of variability. That includes being patient and avoiding the temptations to sell just because there has been volatility.

Play Episode 1:

Let’s take the theoretical into the real investing world. Say its last summer and you are enjoying your favorite show on Netflix. You think to yourself, “Hey, Netflix is amazing! I love that I can watch unlimited shows for only $10 a month. I should invest in the stock!” Unfortunately, your timing is terrible. You pick June 11th, the day Netflix stock closes at its recent peak. You watch the stock price take a slow nose dive all the way until Christmas Eve. On 12/24, you see your Netflix stock down 44% from purchase. Compare that to a decline of 14% for the broad market S&P 500 and that is quite the relative move. Ouch!

Are you still watching?

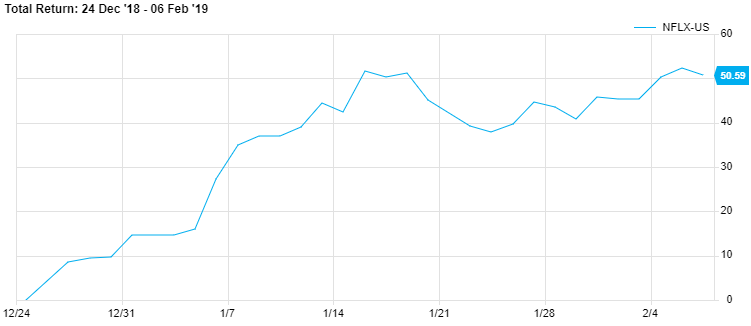

However, you remain undeterred and decide to ride out the stock for the long term. After all, Netflix shows are now being considered for Oscar and Emmy contention. Surely, that will benefit the value of the company. You take the 12/24 stock price as a point of reference and then decide to see how the stock is currently doing. It’s now February 6th and the stock is up about 51% from that low point on Christmas Eve. That’s what I’m talking about!

Rate your experience:

As investors, sometimes we segment notable periods of stock ownership like this to keep score. “Yeah, it was down 44%, but it’s been up 51% since then!” Ultimately, the entire time horizon is the yard stick to judge if value was created or destroyed. Looking at the return path from when you bought Netflix stock (7/11/18) to now (2/6/19), you see that you are down 16% on your position. Bummer.

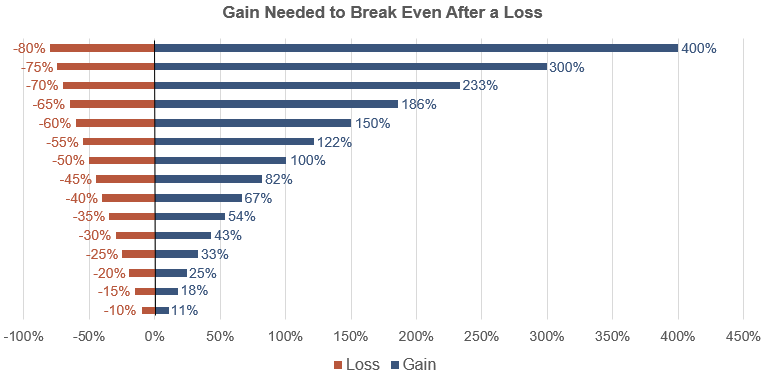

This is where the concept of volatility affects returns. A more volatile stock is one that goes up or down by a greater percentage than others. If a stock is down 10%, it needs a subsequent 11% return to recoup the entire loss. If it’s down 20%, it needs to go up 25% from there to have a similar result. The chart below shows how asymmetric these relationships can be the farther the stock falls.

A main tenet of diversification in investment portfolios is to reduce the amount of volatility and improve your long-term returns. Diversifying will involve offsetting the big winners and losers in the portfolio and making the combination a smoother ride. And by softening those losses, the portfolio won’t have to work as hard to make them up in gains. Sounds good to me.