Artificial Intelligence investment hype is stratospheric. And for good cause: AI technology capabilities are increasing exponentially, and the stock market’s performance for the past couple of years has been primarily driven by the success of a handful of tech stocks that stand to benefit from the adoption of AI. A case-in-point is Nvidia, a supplier of computer chips used in AI, whose stock has increased by 5x in two years. And there is no bigger investment theme right now than AI. This begs the question, should investors consider a thematic approach to investing?

Thematic investing is a strategy that allows investors to capitalize on macro-level or structural trends. It involves investing in themes that are broader than a single stock, sector, or index, which are the building blocks of many traditional investing strategies. These themes can range from clean energy and immunology to AI, fintech, cybersecurity, cannabis, and blockchain. The popularity of thematic funds has grown significantly as investment firms strive to identify and package secular growth themes into investable products.

Thematic funds have witnessed a surge in popularity among investors in recent years. These offerings, which allow investments aligned with investors’ convictions, have become a significant part of many portfolios. However, their performance experience serves as a crucial lesson, highlighting the importance of understanding their potential pitfalls.

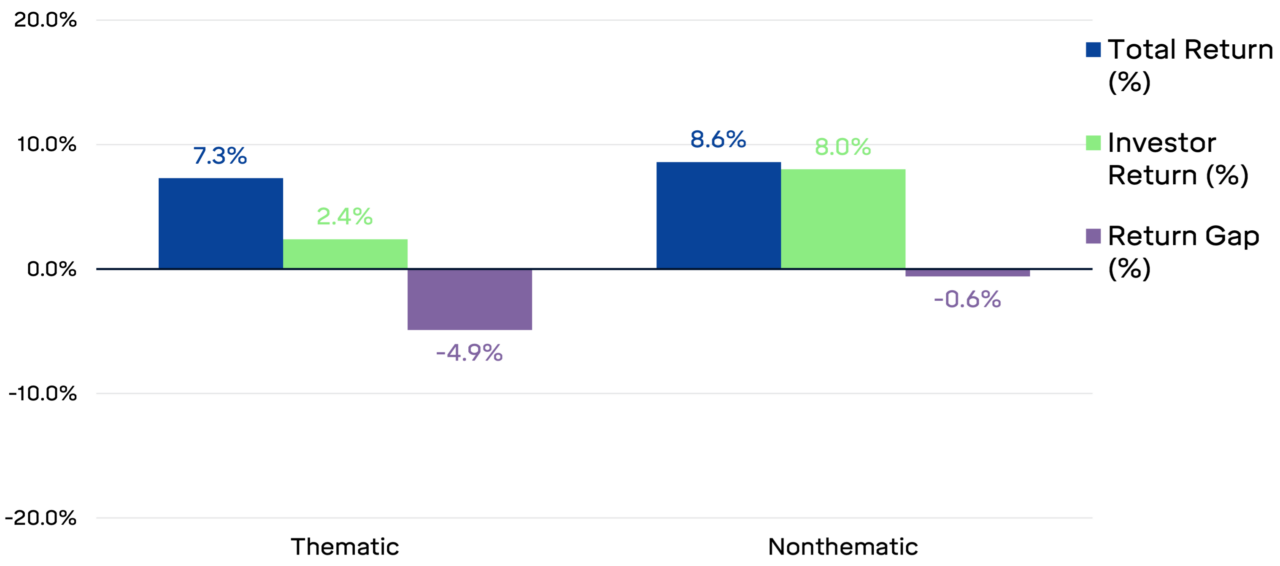

The following analysis from Morningstar shows how thematic and non-thematic funds performed over the five years ending 6/30/23 (blue bars) and the five-year return for investors in these funds (green bars). The difference is then calculated to show the ‘gap’ or difference between the two. A negative return gap means the aggregate investor performance has been lower than the strategies’ performance due to investors’ poor timing.

Five-Year Total Returns, Investor Returns, and Return Gaps

Two things stand out. First, thematic funds trailed non-thematic funds (8.6% vs. 7.3%), suggesting that picking the investment theme du jour isn’t necessarily the best strategy. Second, the return ‘gap’ was much more significant for thematic funds than for nonthematic funds, meaning that thematic investors made poor timing choices regarding when to buy into and sell out of thematic funds. Why might this be the case? A primary reason is that thematic strategies tend to be esoteric and more volatile than traditional, diversified strategies, which makes it harder to stay invested. Additionally, thematic investors are more likely to base their investment decisions on past performance as validation that the theme is successful. Classic performance chasing.

Thematic investing, while not inherently flawed, carries significant risks. It offers investors the opportunity to align their investments with their beliefs and convictions. However, the allure of potentially high returns can lead investors to become market timers in more volatile strategies. This combination can be destructive for investment returns, underscoring the need for a more cautious approach.