Exchange-traded funds (ETFs) came on the scene in 1993 with the launch of the SPDR® S&P 500® ETF Trust (SPY), a single stock that tracked the S&P 500 Index. (It has had profound effects on the industry since its launch.) ETFs were created as an alternative to mutual funds and have seen massive growth, with $8.1 trillion of assets as of the end of 2023. ETFs are synonymous with passive index investing, while mutual funds have been the primary investment vehicle for active investors. But ETFs and mutual funds aren’t separate investing styles; they are structures. And within the past few years, active managers have embraced the structure and launched their own ETF strategies, referred to in the industry as “Active ETFs.” Should investors also embrace active management in ETF form? Its structure may improve the odds of investment success, but it’s no guarantee.

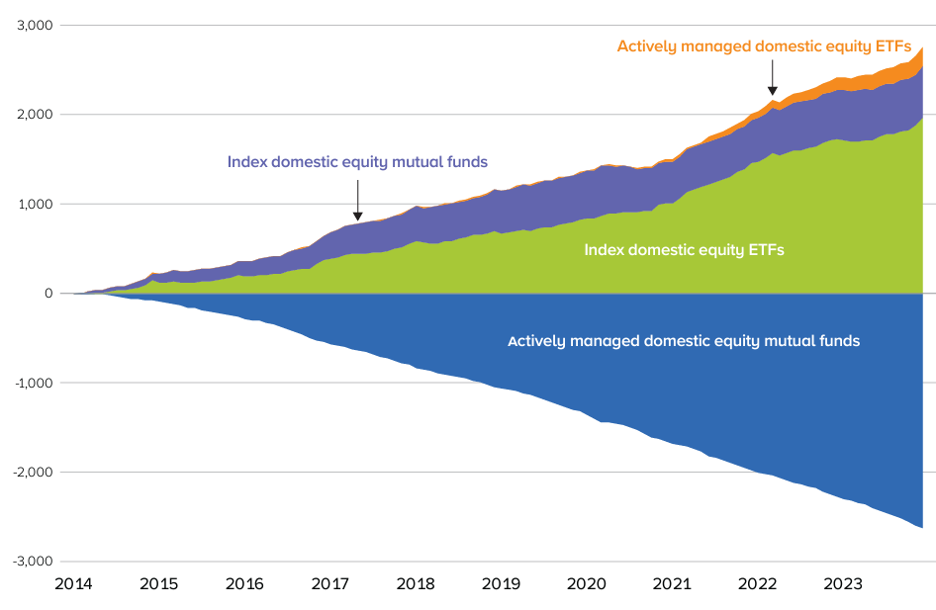

Actively managed mutual funds have struggled to outperform their respective benchmarks, leading to massive outflows. The chart below shows the cumulative flows for domestic equity funds and ETFs over the past decade. The trend is unwavering. Actively managed mutual funds have seen net outflows of $2.6 trillion, while index-tracking mutual funds and ETFs saw $2.5 trillion in inflows. Thus, the conclusion of a large swath of the investment community is that passive investing is superior to active management.

Cumulative flows to domestic equity mutual funds and net share issuance of domestic equity ETFs

(Billions of dollars, monthly)

Why is this occurring? The main catalyst for the broadening adoption of active ETFs goes back to 2019, when the SEC passed the “ETF Rule,” enabling ETF issuers to come to market more easily and avoid the previously onerous regulations and speed bumps. But the bigger tailwind to adoption is that ETFs, irrespective of investment strategy, are a better way to structure an investment fund:

- ETFs tend to have lower expense ratios than comparable mutual funds.

- The underlying holdings are published more frequently, providing investors with added transparency.

- ETFs trade like stocks, so you can buy and sell during the day versus waiting for the end of the day like mutual funds.

- ETFs are generally more tax-efficient than traditional mutual funds because their structure allows the fund manager to minimize capital gain distributions.

Will the packaging of active strategies as ETFs prove beneficial for investors? It’s still too early to make a definitive judgment. The inherent risks of active management don’t simply vanish by changing the packaging. There are challenges and opportunities to consider. It remains a challenge to identify and stick with skilled managers and many active ETF launches feature esoteric or thematic strategies that can encourage performance chasing and poor market timing. However, the structure itself offers advantages, including enhanced liquidity, transparency, tax efficiency, and lower costs compared to a comparable mutual fund. Taken all together, this is a step in the right direction for investors, but not a panacea.