In his investment book “Where are the Customers’ Yachts?” Fred Schwed opens with the story that gives the book its title:

Once in the dear dead days beyond recall, an out-of-town visitor was being shown the wonders of the New York Financial District. When the party arrived at the battery, one of his guides indicated some handsome ships riding at anchor.

He said, ‘look, those are the bankers’ and brokers’ yachts.’

‘Where are the customers’ yachts?’ asked the naïve visitor.

Although the wealth management industry has evolved since Schwed’s book was published 81 years ago, the underlying issue remains: it is first and foremost a money-making machine for those who work in the industry. This doesn’t mean the wealth management sector is made up of bad people (I’m one of them!) but rather that their incentives aren’t usually aligned with acting in clients’ best interests. Like Upton Sinclair says, “It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

According to Roman Catholic theology, the seven deadly sins are the primary feelings or behaviors that inspire further sin. The misaligned incentives of the wealth management industry roughly correspond to those deadly sins, and knowing them is essential to being a wise consumer of financial services. Once you understand what drives the wealth management industry, you can better choose which advisors to work with, evaluate their advice with clear eyes, and push back as necessary.

The seven deadly sins of the wealth management industry are:

- Advisors are incentivized to provide the least amount of service possible (sloth). An investment professional I know who works in the trust department of a large bank told me that a common refrain at their bank is “don’t wake the dead.” In other words, don’t call clients unless they call you first. There’s a fundamental tradeoff in any business between customization and scalability. And it’s particularly acute in the financial services industry. Wealth management firms are incentivized to scale rather than customize because the more clients they can serve with limited people and resources, the higher the profits. By ignoring clients and being reactive rather than proactive, advisors can handle huge client loads, collect more fees and increase firm profitability.

- Advisors spend most of their time looking for their next client (lust). Years ago, I interviewed an advisor from a global investment brokerage who was looking to change jobs. When I asked why he was interested in our much smaller boutique firm, he told me he went into the financial services business to help people but doesn’t get to do that much. “About 80% of my time is spent on business development, and only 20% on actually advising and helping my clients,” he said. Unfortunately, this is common in wealth management firms because they’re structured so that advisors “eat what they kill.” To make more money, they must constantly obtain new clients. As a result, most advisors spend most of their time wooing new clients instead of caring for those they already have.

- Most advisors are compensated based on revenue and profitability, making them view clients as profit centers (greed). The compensation structure for most financial advisors creates an inherent conflict of interest that can lead to bad advice. For example, while reviewing the portfolio of a new client, we noticed he had a substantial margin loan. When we asked about the purpose of the loan, he said his previous advisor had recommended he use a loan rather than sell investments to fund his living expenses. Considering that the advisor was compensated based on a percentage of this client’s invested assets, this advice was suspect. By recommending a margin loan, the advisor not only maintained the full level of fees from the client’s investment assets but also earned fees on the loan.I’ve also seen advisors discourage clients from making lifetime charitable gifts because it would reduce the assets under management and, in turn, the advisor’s fees. Or they use a higher fee mutual fund even though the fund has a lower fee share class because they make more money from the higher fee one. Similarly, many investment firms sell structured products like hotcakes because they are very lucrative for them but not necessarily for their clients. These are just a few examples.

- Wealth managers introduce needless complexity to justify their existence (wrath). Investment diversification is essential, but most portfolios are stuffed with way more funds than is needed. Why do advisors use five funds when one would suffice? A primary reason is the Shirky Principle, which holds that “institutions will try to preserve the problem to which they are the solution.” If advisors design simple portfolios, why would their clients need them?I experienced this first-hand at a seminar for investment professionals who work for family offices. The 40 of us were divided into six investment committees and tasked with recommending an investment strategy for a hypothetical client family that had recently sold its business for hundreds of millions of dollars. The first five investment committees presented similarly complex portfolios with allocations to muni bonds, taxable bonds, high yield bonds, distressed debt, equity index funds, actively managed funds, growth and value funds, large and small-cap funds, developed and emerging markets international funds, hedge funds of various styles, private real estate, venture capital, and so on. Their pie charts were colorful and had many slices. By contrast, our investment committee, which presented last, proposed a portfolio of two funds: a muni bond fund and an index fund that tracked the global stock market. At first, the other participants were incredulous. It seemed crazy to suggest such a simple portfolio. But when our committee asked who was confident their complex portfolio would beat our simple one, no one raised their hand. A chief investment officer for a multi-billion-dollar family office noted that the biggest problem with our portfolio wasn’t its likely after-tax performance but that he’d have to fire his staff of 10 investment analysts and possibly himself.

- Most advisors won’t say “I don’t know” (pride). The economy and stock market are inherently uncertain. Pandemics, boats stuck in canals, major pipeline hacks, terrorist attacks, Elon Musk tweets, and a host of other unpredictable events affect the economy and financial markets. The wealth management industry typically responds to all this uncertainty with overconfidence. Predictions of what the stock market will return and how clients should shift their portfolios are the rule rather than the exception. Yet investment professionals’ track records show they are terrible at making these predictions. But they continue to do it anyway. Why? One reason is that they think their clients expect them to have all the answers, so they don’t feel comfortable being honest about not knowing what will happen in a financial system that’s inherently nonsensical. But which do you think is better? Investing in flawed predictions or constructing portfolios with the recognition that the future is uncertain?

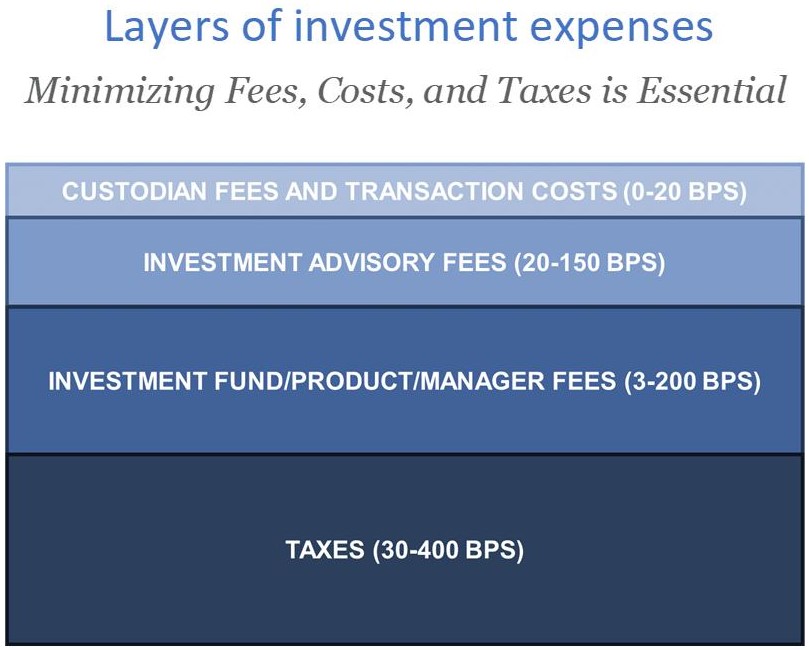

- Lack of transparency about fees (gluttony – sort of). This wealth management sin is more dishonesty than anything else, but it’s driven by gluttony: the desire to feed the endless craving for more fees. Even if your wealth management firm clearly states their management fee, such as a percentage of assets under management, figuring out the total fees you’re paying is tough. Underlying investments also charge fees, which can take some digging to figure out. For example, when we became the family office for a client whose investments were spread across several large banks and brokerage firms, one of our first projects was to find out how much he was paying in total fees. When we asked the relationship managers at the investment firms, they didn’t know or were reluctant to tell us. It took one of our junior analysts hours of pouring through fund prospectuses to arrive at an answer, which was that our new client had been paying fees much higher than he realized. Because high fees are a significant drag on investment returns, doing this calculation is essential.

- The tax drag of investments is treated as secondary or ignored altogether (not exactly envy, but it’s the only deadly sin left). Like fees, taxes weaken investment performance. In fact, they’re typically greater than or equal to the total investment management fees. Yet, the wealth management industry tends to pay lip service to the tax drag on a portfolio. They use sophisticated software to track investment performance, but tax drag isn’t something they report. It takes work to figure out how much tax is generated by various investments. Advisors may use portfolio turnover as a proxy for tax efficiency, but that’s only a rough estimation. Assessing the actual tax drag requires looking through a client’s 1099s or tax returns. Considering the impact that taxes have on returns, this is a massive industry oversight.

What to Do About Sins

Most advisors aren’t sitting around the office thinking of new ways to underserve and overcharge clients. Rather, the seven deadly sins are subtle; advisors serve multiple masters, and clients aren’t usually at the top due to misaligned incentives.

As a financial services consumer, the most effective thing you can do is choose an advisor at a wealth management firm that has structured itself to minimize the seven deadly sins. To do this ask prospective and current advisors questions such as:

- How does your firm make money? Do you receive any income from products? Any indirect compensation from any other financial firm?

- How are your people compensated, and on what metrics is their compensation based?

- What metrics do you use to assess client profitability?

- How many other clients does my advisory team serve?

- How do you incorporate tax efficiency into your portfolio recommendations?

- Will you provide a completely transparent report of all fees that my portfolio will incur?

The answers to these questions will reveal to what extent your relationship with your advisor will be negatively affected by self interest. You work hard for your money and deserve to have a yacht, too.