Each of the past three years, I’ve published my forecast for what the stock market will do in the coming year. And I’m proud that these previous forecasts have been spot-on correct. Here they are:

2020 prediction: The market will probably be up but might be down. Result: the market was up.

2021 prediction: The market will probably be up but might be down. Result: the market was up.

2022 prediction: The market will probably be up but might be down. Result: the market was down.

What’s my prediction for 2023? More of the same: the market will probably be up, but there’s a decent chance it will be down.

Why is This My Annual Prediction?

You may think I’m kidding by making these non-specific predictions, but I’m not. I know these predictions are unsatisfying, yet they are about as precise as anyone can be about predicting market returns.

Here are a few reasons why my prediction makes sense:

1. It’s What History Teaches Us

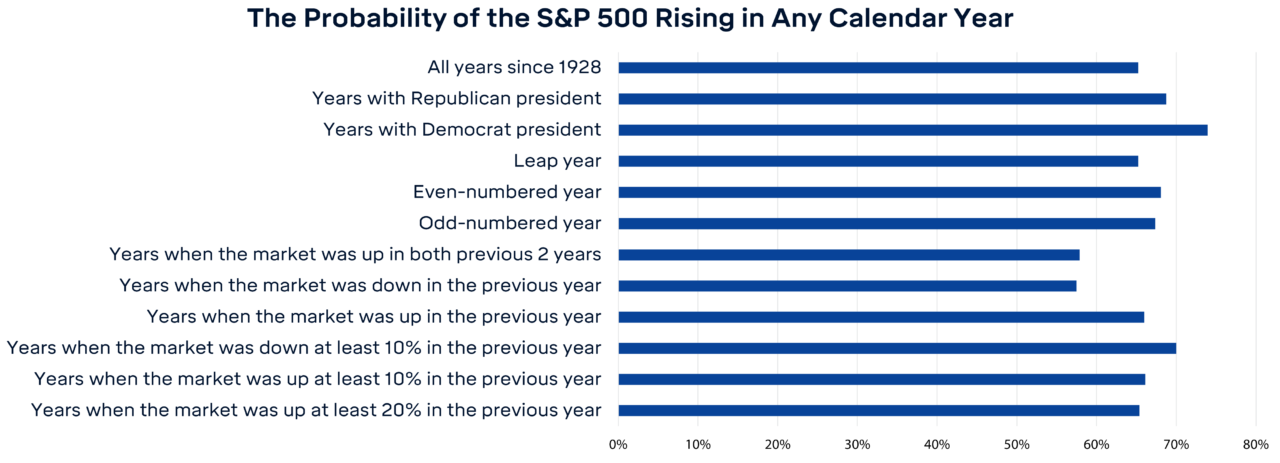

I am confident in my prediction because it reflects what has happened historically — the stock market has appreciated about two in every three years, regardless of whatever had gone before, including down years – see chart.

ST. LOUIS TRUST & FAMILY OFFICE

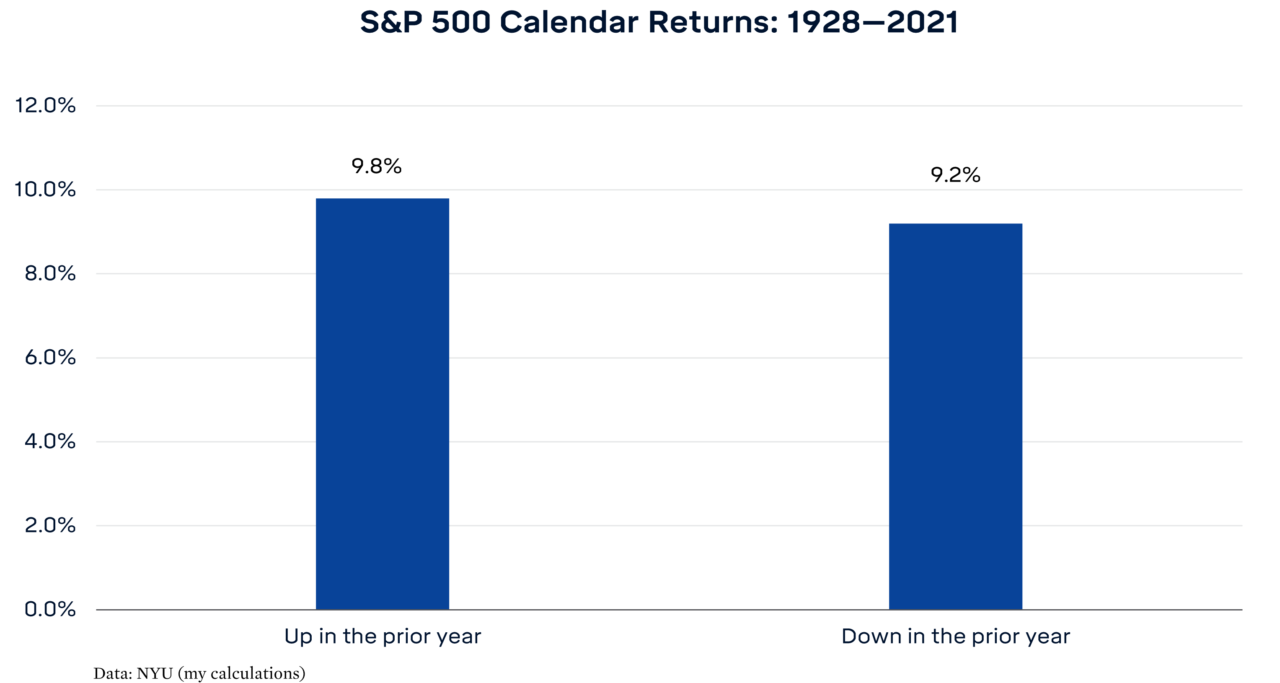

Similarly, an analysis by Ben Carlson of stock returns between 1928 and 2021 found that on average the stock market is up about an equivalent amount following both up and down years. He found that the average return following an up year was 9.8% and 9.2% after a down year.

BEN CARLSON – A WEALTH OF COMMON SENSE BLOG

2. Because Economic Indicators Don’t Tell Us What the Stock Market Will Do

As I note in my upcoming book, The Uncertainty Solution: How to Invest With Confidence in the Face of the Unknown, common economic indicators followed by investors don’t predict market returns. A 2012 study by Vanguard supports this conclusion. In the study, Vanguard analyzed stock market returns from 1926 to 2011 compared to various economic indicators and stock market signals to see if they could predict future returns.

The study looked at price-to-earnings ratios (P/E ratios), government debt levels, dividend yields, GDP growth, corporate earnings, treasury yields, and trailing stock market returns, among others.

What did the study find? None of the indicators showed significant predictive ability in forecasting the following year’s returns, and only P/E ratios had a meaningful predictive value for longer-term returns.

Academic studies confirm Vanguard’s conclusions. For example, researchers from Emory and Yale examined common indicators similar to the ones the Vanguard study looked at and found that “not a single one would have helped a real-world investor outpredicting the then-prevailing historical equity premium mean. Most would have outright hurt. Therefore, we find that, for all practical purposes, the equity premium has not been predictable.”

3. Because It’s Better Than Precise Expert Predictions

My prediction for 2023 isn’t precise. But it won’t be wrong, which is way better than industry experts who provide precise predictions annually.

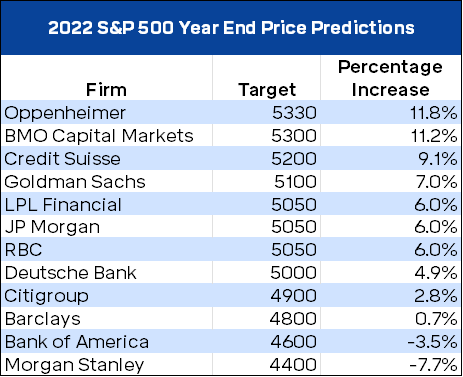

A year ago, the Wall Street consensus was that the S&P 500 would reach 4,825, a modest increase of about 2%, far off the nearly 20% decline we experienced in 2022. Specifically, here are the 2022 predictions of some of the biggest investment firms:

ST. LOUIS TRUST & FAMILY OFFICE

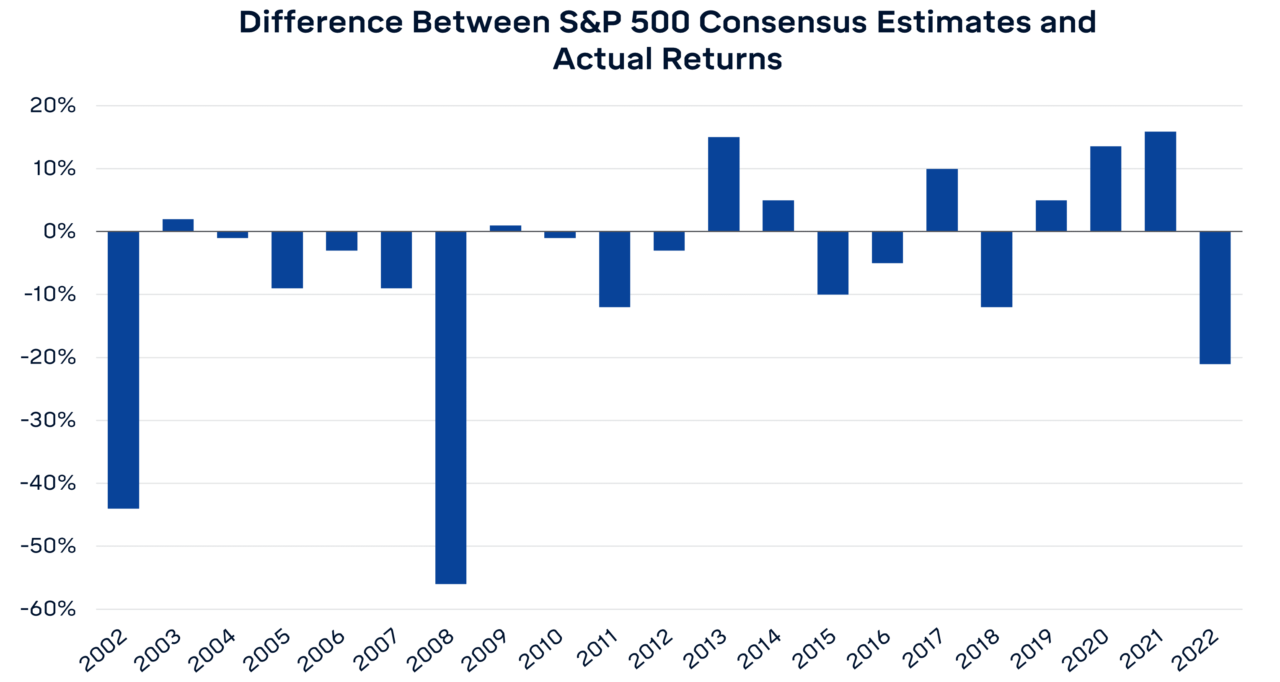

As the above table shows, none of the firms’ predictions were remotely close. And they are consistent with the poor track record of expert predictions in other years. The wrongheaded predictions of 2022 were not outliers; 2022 was not exceptional; market predictions are always toss-ups. Don’t believe me? The below figure shows how far off the consensus S&P 500 prediction was from the actual return by year.

ST. LOUIS TRUST & FAMILY OFFICE

I draw three conclusions from the data on stock market predictions versus reality in the above figure:

- The correlation between analyst predictions and what happens is a mere 0.15. In other words, expert stock market predictions and what actually occurs bear almost no relationship to each other.

- The predictions were mainly too bullish; the difference is negative in thirteen of the twenty-one range years or about 62% of the time.

- Expert market predictions are wrong when we need them most. Their biggest misses were in not predicting the bear markets in 2002 and 2008, missing what the S&P 500 actually returned by more than 40 percent and 50 percent, respectively. Likewise, they didn’t predict the horrible returns of 2022.

What to do With My 2023 Prediction

My prediction that the stock market probably will be up but might be down may seem useless, but it’s not. It provides a rough idea of what the market will do next year, which is the best anyone can do. It’s better to make investment decisions based on a non-specific yet correct prediction than acting on specific but hopelessly wrong ones.

My advice is to shut off the noise of what may (or may not) be happening in the economy and geopolitics and resist listening to investment experts’ predictions of the future.