Following a stellar 26% return in 2023, the S&P 500 delivered again in 2024, with a return of 25.02%. After two back-to-back blockbuster years, investors are understandably asking: Will 2025 be the year the rally ends? Could the market come crashing down, or will the good times keep rolling?

It’s a fair question. But if you’ve followed my prior predictions or read my book, you already know my answer: Trying to predict the stock market’s return with specificity in any given year is a fool’s errand.

That said, I do have a useful (yet non-specific) prediction for 2025. It’s grounded in historical data and offers a balanced perspective to help you make informed investment decisions. But before we hit that prediction, let’s learn from the market’s past returns and cycles.

Lessons From History: What Happens After Two Strong Years?

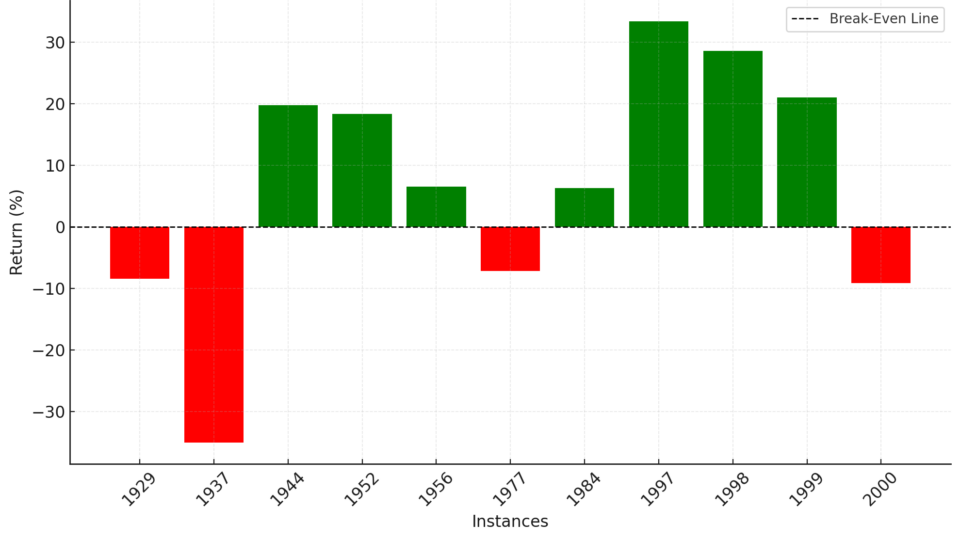

Since 1926, the S&P 500 has had two consecutive years of 20% plus returns on 11 occasions. And what happened in the third year? The results were mixed:

- The market was positive 60% of the time, with gains as high as 19.75%.

- But it was negative 40% of the time, including a dramatic -35% drop in 1937.

Here’s a chart to illustrate the data:

S&P 500 Returns in the Third Year After Two Consecutive Strong Years

St. Louis Trust & Family Office | Data from Macrotrends

Key Takeaways from the Data:

- Average Return in the Third Year: A modest 0.65%, far below the blockbuster performances of the preceding years. However, this average hides massive variability—some years were great, others were terrible.

- Market Declines Were Rarely Severe: Apart from 1937, downturns were relatively mild (less than 10%), suggesting that crashes aren’t the norm in the year following two strong years.

- Speculative Momentum Can Persist: The Dotcom Bubble saw an incredible five consecutive years of 20%+ returns, proving that speculative euphoria can last longer than expected. Back then it was frenzy due to the promise of the internet. This time, it’s AI that is fueling the market’s eye-popping returns. Will the euphoria continue? It might.

- Sample Size is Small: With only 11 instances over 98 years, it’s important not to over-interpret this data.

And here’s the kicker: That 60/40 split isn’t far off from the market’s long-term trend. Historically, the S&P 500 is positive about 70% of the time, regardless of what the returns were the year before, who’s in the White House, or whether the AFC or NFC wins the Super Bowl.

My 2025 Stock Market Prediction

With all of this as background, my prediction is the market will probably be up, but it might be down.

This prediction is as accurate as you can be while still being correct. I’ve made the same prediction every year since 2020, and I’ve been right all five years (likely earning me the title of the most successful stock market predictor over the past five years, LOL).

Yes, it sounds like I’m dodging the question, but this prediction is actually incredibly useful. Why? Because it’s grounded in reality. And it’s better to make investment decisions based on a non-specific but accurate prediction than to act on specific but hopelessly wrong ones.

How to Use This Prediction

Here’s how you can turn this seemingly vague forecast into actionable advice:

- Stay Invested if You’re Worried. The market will probably be up, so don’t let fear of a downturn push you out of your investments.

- Invest Cash If You Have It. With markets historically up most of the time, chances are your cash will grow faster in the market than sitting idle. However, if this is a once-in-a-lifetime influx (e.g., selling a business), consider investing over time. Why? Because while the market will probably be up, it might be down and investing over time reduces the risk of investing at a market top. For more on this topic, check out my article You’ve Received an Influx of Cash. Is It Best to Invest It as a Lump Sum or by Dollar-Cost Averaging?

- Prepare for the Unexpected. While the odds favor an up year, downturns are inevitable. Design your portfolio to weather the bad years. Keep enough liquidity to fund expected and unexpected expenses and avoid being forced to sell assets during a downturn.

The Bottom Line

Trying to predict the market’s next move with precision is a losing game. History shows that patience, not predictions, is what rewards investors over time. So instead of worrying about what 2025 will bring, focus on what you can control:

- Stay diversified.

- Stay disciplined.

- And most importantly, stay invested.